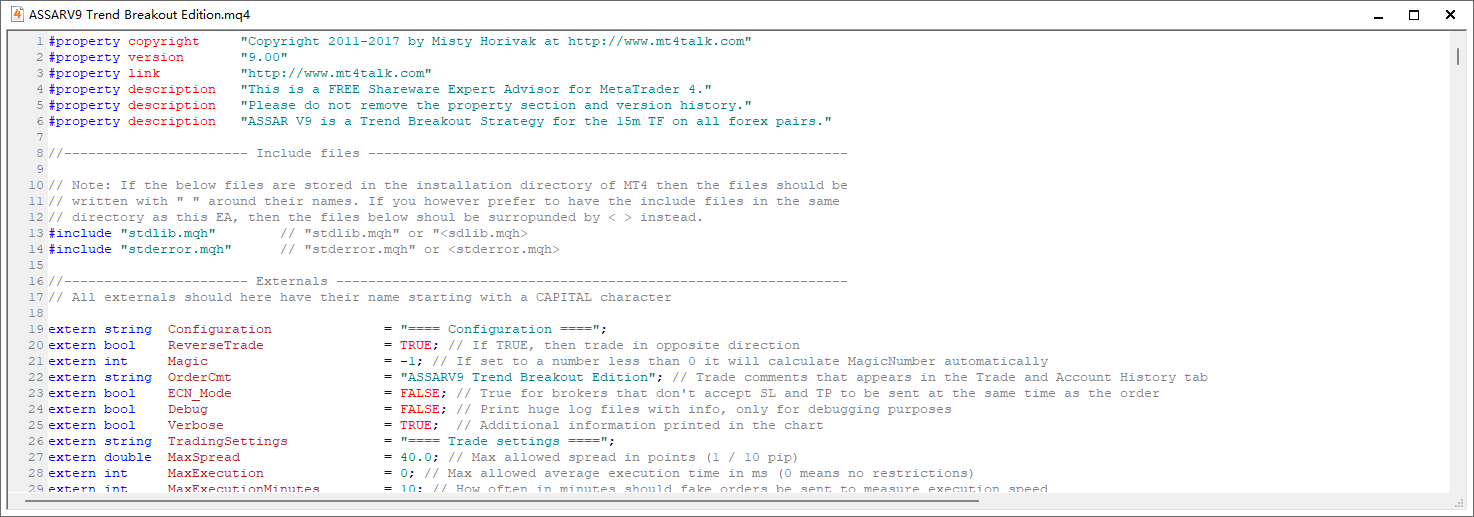

#property copyright “Copyright 2011-2017 by Misty Horivak at http://www.mt4talk.com”

#property version “9.00”

#property link “http://www.mt4talk.com”

#property description “This is a FREE Shareware Expert Advisor for MetaTrader 4.”

#property description “Please do not remove the property section and version history.”

#property description “ASSAR V9 is a Trend Breakout Strategy for the 15m TF on all forex pairs.”//———————– Include files ————————————————————

// Note: If the below files are stored in the installation directory of MT4 then the files should be

// written with ” ” around their names. If you however prefer to have the include files in the same

// directory as this EA, then the files below shoul be surropunded by < > instead.

#include “stdlib.mqh” // “stdlib.mqh” or “<sdlib.mqh>

#include “stderror.mqh” // “stderror.mqh” or <stderror.mqh>//———————– Externals —————————————————————-

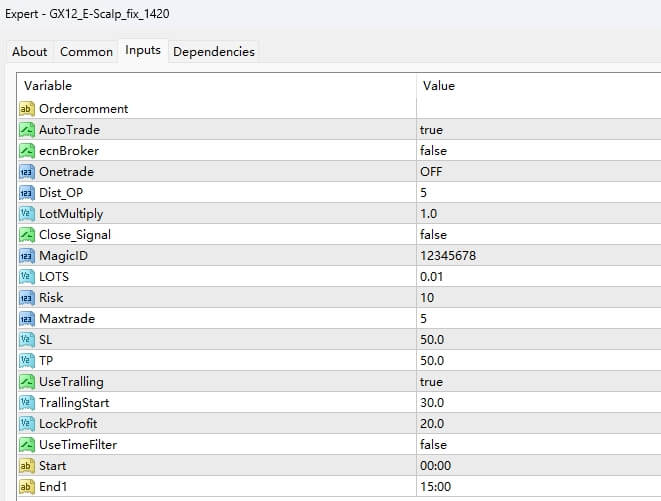

// All externals should here have their name starting with a CAPITAL characterextern string Configuration = “==== Configuration ====”;

extern bool ReverseTrade = TRUE; // If TRUE, then trade in opposite direction

extern int Magic = -1; // If set to a number less than 0 it will calculate MagicNumber automatically

extern string OrderCmt = “ASSARV9 Trend Breakout Edition”; // Trade comments that appears in the Trade and Account History tab

extern bool ECN_Mode = FALSE; // True for brokers that don’t accept SL and TP to be sent at the same time as the order

extern bool Debug = FALSE; // Print huge log files with info, only for debugging purposes

extern bool Verbose = TRUE; // Additional information printed in the chart

extern string TradingSettings = “==== Trade settings ====”;

extern double MaxSpread = 40.0; // Max allowed spread in points (1 / 10 pip)

extern int MaxExecution = 0; // Max allowed average execution time in ms (0 means no restrictions)

extern int MaxExecutionMinutes = 10; // How often in minutes should fake orders be sent to measure execution speed

extern double StopLoss = 800; // StopLoss from as many points. Default 60 (= 6 pips)

extern double TakeProfit = 800; // TakeProfit from as many points. Default 100 (= 10 pip)

extern double AddPriceGap = 20; // Additional price gap in points added to SL and TP in order to avoid Error 130

extern double TrailingStart = 20; // Start trailing profit from as so many pips. Default 23

extern double Commission = 0; // Some broker accounts charge commission in USD per 1.0 lot. Commission in dollar

extern int Slippage = 5; // Maximum allowed Slippage in points

extern double MinimumUseStopLevel = 0; // Minimum stop level. Stoplevel to use will be max value of either this value or broker stoplevel

extern string VolatilitySettings = “==== Volatility Settings ====”;

extern bool UseDynamicVolatilityLimit = FALSE; // Calculate VolatilityLimit based on INT (spread * VolatilityMultiplier)

extern double VolatilityMultiplier = 125; // Dynamic value, only used if UseDynamicVolatilityLimit is set to TRUE

extern double VolatilityLimit = 325; // Fix value, only used if UseDynamicVolatilityLimit is set to FALSE

extern bool UseVolatilityPercentage = TRUE; // If true, then price must break out more than a specific percentage

extern double VolatilityPercentageLimit = 125; // Percentage of how much iHigh-iLow difference must differ from VolatilityLimit. 0 is risky, 60 means a safe value

extern string UseIndicatorSet = “=== Indicators: 1 = Moving Average, 2 = BollingerBand, 3 = Envelopes”;

extern int UseIndicatorSwitch = 3; // Switch User indicators.

extern int Indicatorperiod = 3; // Period in bars for indicators

extern int BBDeviation = 2; // Deviation for the iBands indicator

extern double EnvelopesDeviation = 0.07; // Deviation for the iEnvelopes indicator

extern int OrderExpireSeconds = 1800; // Orders are deleted after so many seconds

extern string Money_Management = “==== Money Management ====”;

extern bool MoneyManagement = TRUE; // If TRUE then calculate lotsize automaticallay based on Risk, if False then use ManualLotsize below

extern double MinLots = 0.01; // Minimum lot-size to trade with

extern double MaxLots = 1000.0; // Maximum allowed lot-size to trade with

extern double Risk = 1.0; // Risk setting in percentage, For 10.000 in Equity 10% Risk and 60 StopLoss lotsize = 16.66

extern double ManualLotsize = 0.01; // Manual lotsize to trade with if MoneyManagement above is set to FALSE

extern string Screen_Shooter = “==== Screen Shooter ====”;

extern bool TakeShots = FALSE; // Save screen shots on STOP orders?

extern int DelayTicks = 1; // Delay so many ticks after new bar

extern int ShotsPerBar = 1; // How many screen shots per bar//————————— Globals ————————————————————–

// All globals have their name written in lower case charactersstring ea_version = “ASSARV9 Trend Breakout Edition”;

int brokerdigits = 0; // Nnumber of digits that the broker uses for this currency pair

int globalerror = 0; // To keep track on number of added errors

int lasttime = 0; // For measuring tics

int tickcounter = 0; // Counting tics

int upto30counter = 0; // For calculating average spread

int execution = -1; // For execution speed, -1 means no speed

int avg_execution = 0; // Average execution speed

int execution_samples = 0; // For calculating average execution speed

int starttime; // Initial time

int leverage; // Account leverage in percentage

int lotbase; // Amount of money in base currency for 1 lot

int err_unchangedvalues; // Error count for unchanged values (modify to the same values)

int err_busyserver; // Error count for busy server

int err_lostconnection; // Error count for lost connection

int err_toomanyrequest; // Error count for too many requests

int err_invalidprice; // Error count for invalid price

int err_invalidstops; // Error count for invalid SL and/or TP

int err_invalidtradevolume;// Error count for invalid lot size

int err_pricechange; // Error count for change of price

int err_brokerbuzy; // Error count for broker is buzy

int err_requotes; // Error count for requotes

int err_toomanyrequests; // Error count for too many requests

int err_trademodifydenied; // Error count for modify orders is denied

int err_tradecontextbuzy; // error count for trade context is buzy

int skippedticks = 0; // Used for simulation of latency during backtests, how many tics that should be skipped

int ticks_samples = 0; // Used for simulation of latency during backtests, number of tick samplesdouble array_spread[30]; // Store spreads for the last 30 tics

double lotsize; // Lotsize

double highest; // Highest indicator value

double lowest; // Lowest indicator value

double stoplevel; // Broker stoplevel

double stopout; // Broker stoput percentage

double lotstep; // Broker lotstep

double marginforonelot; // Margin required for 1 lot

double avg_tickspermin = 0;// Used for simulation of latency during backtests//======================= Program initialization ===================================================

int init()

{

// Print short message at the start of initalization

Print (“====== Initialization of “, ea_version, ” ======”);// Reset time for execution control

starttime = TimeLocal();// Reset error variable

globalerror = -1;// Get the broker decimals

brokerdigits = Digits;// Get leverage

leverage = AccountLeverage();// Calculate stoplevel as max of either STOPLEVEL or FREEZELEVEL

stoplevel = MathMax ( MarketInfo ( Symbol(), MODE_FREEZELEVEL ), MarketInfo ( Symbol(), MODE_STOPLEVEL ) );

// Then calculate the stoplevel as max of either this stoplevel or MinimumUseStopLevel

stoplevel = MathMax ( MinimumUseStopLevel, stoplevel );// Get stoput level and re-calculate as fraction

stopout = AccountStopoutLevel();// Calculate lotstep

lotstep = MarketInfo ( Symbol(), MODE_LOTSTEP );// Check to confirm that indicator switch is valid choices, if not force to 1 (Moving Average)

if (UseIndicatorSwitch < 1 || UseIndicatorSwitch > 4)

UseIndicatorSwitch = 1;// If indicator switch is set to 4, using iATR, tben UseVolatilityPercentage cannot be used, so force it to FALSE

if (UseIndicatorSwitch == 4)

UseVolatilityPercentage = FALSE;// Adjust SL and TP to broker stoplevel if they are less than this stoplevel

StopLoss = MathMax ( StopLoss, stoplevel );

TakeProfit = MathMax ( TakeProfit, stoplevel );// Re-calculate variables

VolatilityPercentageLimit = VolatilityPercentageLimit / 100 + 1;

VolatilityMultiplier = VolatilityMultiplier / 10;

ArrayInitialize ( array_spread, 0 );

VolatilityLimit = VolatilityLimit * Point;

Commission = sub_normalizebrokerdigits ( Commission * Point );

TrailingStart = TrailingStart * Point;

stoplevel = stoplevel * Point;

AddPriceGap = AddPriceGap * Point;// If we have set MaxLot and/or MinLots to more/less than what the broker allows, then adjust it accordingly

if ( MinLots < MarketInfo ( Symbol(), MODE_MINLOT ) )

MinLots = MarketInfo ( Symbol(), MODE_MINLOT );

if ( MaxLots > MarketInfo ( Symbol(), MODE_MAXLOT ) )

MaxLots = MarketInfo ( Symbol(), MODE_MAXLOT );

if ( MaxLots < MinLots )

MaxLots = MinLots;// Calculate margin required for 1 lot

marginforonelot = MarketInfo ( Symbol(), MODE_MARGINREQUIRED );// Amount of money in base currency for 1 lot

lotbase = MarketInfo ( Symbol(), MODE_LOTSIZE );// Also make sure that if the risk-percentage is too low or too high, that it’s adjusted accordingly

sub_recalculatewrongrisk();// Calculate intitial lotsize

lotsize = sub_calculatelotsize();// If magic number is set to a value less than 0, then calculate MagicNumber automatically

if (Magic < 0)

sub_magicnumber();// If execution speed should be measured, then adjust maxexecution from minutes to seconds

if (MaxExecution > 0)

MaxExecutionMinutes = MaxExecution * 60;// Print initial info

sub_printdetails();// Print short message at the end of initialization

Print (“========== Initialization complete! ===========\n”);// Finally call the main trading subroutine

start();return (0);

}//======================= Program deinitialization =================================================

int deinit()

{

string local_text = “”;// If we run backtests and simulate latency, then print result

if (IsTesting() && MaxExecution > 0)

{

local_text = local_text + “During backtesting ” + skippedticks + ” number of ticks was “;

local_text = local_text + “skipped to simulate latency of up to ” + MaxExecution + ” ms”;

sub_printandcomment ( local_text );

}// Print summarize of broker errors

sub_printsumofbrokererrors();// Print short message when EA has been deinitialized

Print ( ea_version, ” has been deinitialized!” );return ( 0 );

}//==================================== Program start ===============================================

int start()

{

// We must wait til we have enough of bar data before we call trading routine

if ( iBars ( Symbol(), PERIOD_M15 ) > Indicatorperiod )

sub_trade();

else

Print ( “Please wait until enough of bar data has been gathered!” );return ( 0 );

}//================================ Subroutines starts here =========================================

// All subroutines (aka functions) here have their names starting with sub_

// Exception are the standard routines init(), deinit() and start()

//

// Notation:

// All actual and formal parameters in subs have their names starting with par_

// All local variables in subs have their names starting with local_// This is the main trading subroutine

void sub_trade()

{

string local_textstring;

string local_pair;

string local_indy;bool local_select;

bool local_wasordermodified;

bool local_ordersenderror;

bool local_isbidgreaterthanima;

bool local_isbidgreaterthanibands;

bool local_isbidgreaterthanenvelopes;

bool local_isbidgreaterthanindy;int local_orderticket;

int local_orderexpiretime;

int local_loopcount2;

int local_loopcount1;

int local_pricedirection;

int local_counter1;

int local_counter2;

int local_askpart;

int local_bidpart;double local_ask;

double local_bid;

double local_askplusdistance;

double local_bidminusdistance;

double local_volatilitypercentage;

double local_orderprice;

double local_orderstoploss;

double local_ordertakeprofit;

double local_ihigh;

double local_ilow;

double local_imalow;

double local_imahigh;

double local_imadiff;

double local_ibandsupper;

double local_ibandslower;

double local_ibandsdiff;

double local_envelopesupper;

double local_envelopeslower;

double local_envelopesdiff;

double local_volatility;

double local_spread;

double local_avgspread;

double local_realavgspread;

double local_fakeprice;

double local_sumofspreads;

double local_askpluscommission;

double local_bidminuscommission;

double local_skipticks;// Previous time was less than current time, initiate tick counter

if ( lasttime < Time[0] )

{

// For simulation of latency during backtests, consider only 10 samples at most.

if ( ticks_samples < 10 )

ticks_samples ++;

avg_tickspermin = avg_tickspermin + ( tickcounter – avg_tickspermin ) / ticks_samples;

// Set previopus time to current time and reset tick counter

lasttime = Time[0];

tickcounter = 0;

}

// Previous time was NOT less than current time, so increase tick counter with 1

else

tickcounter ++;// If backtesting and MaxExecution is set let’s skip a proportional number of ticks them in order to

// reproduce the effect of latency on this EA

if ( IsTesting() && MaxExecution != 0 && execution != -1 )

{

local_skipticks = MathRound ( avg_tickspermin * MaxExecution / ( 60 * 1000 ) );

if ( skippedticks >= local_skipticks )

{

execution = -1;

skippedticks = 0;

}

else

{

skippedticks ++;

}

}// Get Ask and Bid for the currency

local_ask = MarketInfo ( Symbol(), MODE_ASK );

local_bid = MarketInfo ( Symbol(), MODE_BID );// Calculate the channel of Volatility based on the difference of iHigh and iLow during current bar

local_ihigh = iHigh ( Symbol(), PERIOD_M15, 0 );

local_ilow = iLow ( Symbol(), PERIOD_M15, 0 );

local_volatility = local_ihigh – local_ilow;// Reset printout string

local_indy = “”;// Calculate a channel on Moving Averages, and check if the price is outside of this channel.

if ( UseIndicatorSwitch == 1 || UseIndicatorSwitch == 4 )

{

local_imalow = iMA ( Symbol(), PERIOD_M15, Indicatorperiod, 0, MODE_LWMA, PRICE_LOW, 0 );

local_imahigh = iMA ( Symbol(), PERIOD_M15, Indicatorperiod, 0, MODE_LWMA, PRICE_HIGH, 0 );

local_imadiff = local_imahigh – local_imalow;

local_isbidgreaterthanima = local_bid >= local_imalow + local_imadiff / 2.0;

local_indy = “iMA_low: ” + sub_dbl2strbrokerdigits ( local_imalow ) + “, iMA_high: ” + sub_dbl2strbrokerdigits ( local_imahigh ) + “, iMA_diff: ” + sub_dbl2strbrokerdigits ( local_imadiff );

}// Calculate a channel on BollingerBands, and check if the price is outside of this channel

if ( UseIndicatorSwitch == 2 )

{

local_ibandsupper = iBands ( Symbol(), PERIOD_M15, Indicatorperiod, BBDeviation, 0, PRICE_OPEN, MODE_UPPER, 0 );

local_ibandslower = iBands ( Symbol(), PERIOD_M15, Indicatorperiod, BBDeviation, 0, PRICE_OPEN, MODE_LOWER, 0 );

local_ibandsdiff = local_ibandsupper – local_ibandslower;

local_isbidgreaterthanibands = local_bid >= local_ibandslower + local_ibandsdiff / 2.0;

local_indy = “iBands_upper: ” + sub_dbl2strbrokerdigits ( local_ibandslower ) + “, iBands_lower: ” + sub_dbl2strbrokerdigits ( local_ibandslower ) + “, iBands_diff: ” + sub_dbl2strbrokerdigits ( local_ibandsdiff );

}// Calculate a channel on Envelopes, and check if the price is outside of this channel

if ( UseIndicatorSwitch == 3 )

{

local_envelopesupper = iEnvelopes ( Symbol(), PERIOD_M15, Indicatorperiod, MODE_LWMA, 0, PRICE_OPEN, EnvelopesDeviation, MODE_UPPER, 0 );

local_envelopeslower = iEnvelopes ( Symbol(), PERIOD_M15, Indicatorperiod, MODE_LWMA, 0, PRICE_OPEN, EnvelopesDeviation, MODE_LOWER, 0 );

local_envelopesdiff = local_envelopesupper – local_envelopeslower;

local_isbidgreaterthanenvelopes = local_bid >= local_envelopeslower + local_envelopesdiff / 2.0;

local_indy = “iEnvelopes_upper: ” + sub_dbl2strbrokerdigits ( local_envelopesupper ) + “, iEnvelopes_lower: ” + sub_dbl2strbrokerdigits ( local_envelopeslower ) + “, iEnvelopes_diff: ” + sub_dbl2strbrokerdigits ( local_envelopesdiff) ;

}// Reset breakout variable as FALSE

local_isbidgreaterthanindy = FALSE;// Reset pricedirection for no indication of trading direction

local_pricedirection = 0;// If we’re using iMA as indicator, then check if there’s a breakout

if ( UseIndicatorSwitch == 1 && local_isbidgreaterthanima == TRUE )

{

local_isbidgreaterthanindy = TRUE;

highest = local_imahigh;

lowest = local_imalow;

}// If we’re using iBands as indicator, then check if there’s a breakout

else if ( UseIndicatorSwitch == 2 && local_isbidgreaterthanibands == TRUE )

{

local_isbidgreaterthanindy = TRUE;

highest = local_ibandsupper;

lowest = local_ibandslower;

}// If we’re using iEnvelopes as indicator, then check if there’s a breakout

else if ( UseIndicatorSwitch == 3 && local_isbidgreaterthanenvelopes == TRUE )

{

local_isbidgreaterthanindy = TRUE;

highest = local_envelopesupper;

lowest = local_envelopeslower;

}// Calculate spread

local_spread = local_ask – local_bid;

// Calculate lot size

lotsize = sub_calculatelotsize();

// calculatwe orderexpiretime

if ( OrderExpireSeconds != 0 )

local_orderexpiretime = TimeCurrent() + OrderExpireSeconds;

else

local_orderexpiretime = 0;// Calculate average true spread, which is the average of the spread for the last 30 tics

ArrayCopy ( array_spread, array_spread, 0, 1, 29 );

array_spread[29] = local_spread;

if ( upto30counter < 30 )

upto30counter++;

local_sumofspreads = 0;

local_loopcount2 = 29;

for ( local_loopcount1 = 0; local_loopcount1 < upto30counter; local_loopcount1 ++ )

{

local_sumofspreads += array_spread[local_loopcount2];

local_loopcount2 –;

}// Calculate an average of spreads based on the spread from the last 30 tics

local_avgspread = local_sumofspreads / upto30counter;// Calculate price and spread considering commission

local_askpluscommission = sub_normalizebrokerdigits ( local_ask + Commission );

local_bidminuscommission = sub_normalizebrokerdigits ( local_bid – Commission );

local_realavgspread = local_avgspread + Commission;// Recalculate the VolatilityLimit if it’s set to dynamic. It’s based on the average of spreads + commission

if ( UseDynamicVolatilityLimit == TRUE )

VolatilityLimit = local_realavgspread * VolatilityMultiplier;// If the variables below have values it means that we have enough of data from broker server.

if ( local_volatility && VolatilityLimit && lowest && highest && UseIndicatorSwitch != 4 )

{

// The Volatility is outside of the VolatilityLimit, so we can now open a trade

if ( local_volatility > VolatilityLimit )

{

// Calculate how much it differs

local_volatilitypercentage = local_volatility / VolatilityLimit;

// In case of UseVolatilityPercentage == TRUE then also check if it differ enough of percentage

if ( ( UseVolatilityPercentage == FALSE ) || ( UseVolatilityPercentage == TRUE && local_volatilitypercentage > VolatilityPercentageLimit ) )

{

if ( local_bid < lowest )

if ( ReverseTrade == FALSE )

local_pricedirection = -1; // BUY or BUYSTOP

else // ReverseTrade == true

local_pricedirection = 1; // SELL or SELLSTOP

else if ( local_bid > highest )

if ( ReverseTrade == FALSE )

local_pricedirection = 1; // SELL or SELLSTOP

else // ReverseTrade == true

local_pricedirection = -1; // BUY or BUYSTOP

}

}

// The Volatility is less than the VolatilityLimit

else

local_volatilitypercentage = 0;

}// Out of money

if ( AccountEquity() <= 0.0 )

{

Comment ( “ERROR — Account Equity is ” + DoubleToStr ( MathRound ( AccountEquity() ), 0 ) );

return;

}// Reset execution time

execution = -1;// Reset counters

local_counter1 = 0;

local_counter2 = 0;// Loop through all open orders (if any) to either modify them or delete them

for ( local_loopcount2 = 0; local_loopcount2 < OrdersTotal(); local_loopcount2 ++ )

{

local_select = OrderSelect ( local_loopcount2, SELECT_BY_POS, MODE_TRADES );

// We’ve found an that matches the magic number and is open

if ( OrderMagicNumber() == Magic && OrderCloseTime() == 0 )

{

// If the order doesn’t match the currency pair from the chart then check next open order

if ( OrderSymbol() != Symbol() )

{

// Increase counter

local_counter2 ++;

continue;

}

// Select order by type of order

switch ( OrderType() )

{

// We’ve found a matching BUY-order

case OP_BUY:

// Start endless loop

while ( TRUE )

{

// Update prices from the broker

RefreshRates();

// Set SL and TP

local_orderstoploss = OrderStopLoss();

local_ordertakeprofit = OrderTakeProfit();

// Ok to modify the order if its TP is less than the price+commission+stoplevel AND price+stoplevel-TP greater than trailingStart

if ( local_ordertakeprofit < sub_normalizebrokerdigits ( local_askpluscommission + TakeProfit * Point + AddPriceGap ) && local_askpluscommission + TakeProfit * Point + AddPriceGap – local_ordertakeprofit > TrailingStart )

{

// Set SL and TP

local_orderstoploss = sub_normalizebrokerdigits ( local_bid – StopLoss * Point – AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_askpluscommission + TakeProfit * Point + AddPriceGap );

// Send an OrderModify command with adjusted SL and TP

if ( local_orderstoploss != OrderStopLoss() && local_ordertakeprofit != OrderTakeProfit() )

{

// Start execution timer

execution = GetTickCount();

// Try to modify order

local_wasordermodified = OrderModify ( OrderTicket(), 0, local_orderstoploss, local_ordertakeprofit, local_orderexpiretime, Lime );

}

// Order was modified with new SL and TP

if ( local_wasordermodified == TRUE )

{

// Calculate execution speed

execution = GetTickCount() – execution;

// If we have choosen to take snapshots and we’re not backtesting, then do so

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

// Break out from while-loop since the order now has been modified

break;

}

// Order was not modified

else

{

// Reset execution counter

execution = -1;

// Add to errors

sub_errormessages();

// Print if debug or verbose

if ( Debug || Verbose )

Print (“Order could not be modified because of “, ErrorDescription(GetLastError()));

// Order has not been modified and it has no StopLoss

if ( local_orderstoploss == 0 )

// Try to modify order with a safe hard SL that is 3 pip from current price

local_wasordermodified = OrderModify ( OrderTicket(), 0, NormalizeDouble ( Bid – 30, brokerdigits ), 0, 0, Red );

}

}

// Break out from while-loop since the order now has been modified

break;

}

// count 1 more up

local_counter1 ++;

// Break out from switch

break;// We’ve found a matching SELL-order

case OP_SELL:

// Start endless loop

while ( TRUE )

{

// Update broker prices

RefreshRates();

// Set SL and TP

local_orderstoploss = OrderStopLoss();

local_ordertakeprofit = OrderTakeProfit();

// Ok to modify the order if its TP is greater than price-commission-stoplevel AND TP-price-commission+stoplevel is greater than trailingstart

if ( local_ordertakeprofit > sub_normalizebrokerdigits(local_bidminuscommission – TakeProfit * Point – AddPriceGap ) && local_ordertakeprofit – local_bidminuscommission + TakeProfit * Point – AddPriceGap > TrailingStart )

{

// set SL and TP

local_orderstoploss = sub_normalizebrokerdigits ( local_ask + StopLoss * Point + AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_bidminuscommission – TakeProfit * Point – AddPriceGap );

// Send an OrderModify command with adjusted SL and TP

if ( local_orderstoploss != OrderStopLoss() && local_ordertakeprofit != OrderTakeProfit() )

{

// Start execution timer

execution = GetTickCount();

local_wasordermodified = OrderModify ( OrderTicket(), 0, local_orderstoploss, local_ordertakeprofit, local_orderexpiretime, Orange );

}

// Order was modiified with new SL and TP

if ( local_wasordermodified == TRUE )

{

// Calculate execution speed

execution = GetTickCount() – execution;

// If we have choosen to take snapshots and we’re not backtesting, then do so

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

// Break out from while-loop since the order now has been modified

break;

}

// Order was not modified

else

{

// Reset execution counter

execution = -1;

// Add to errors

sub_errormessages();

// Print if debug or verbose

if ( Debug || Verbose )

Print ( “Order could not be modified because of “, ErrorDescription ( GetLastError() ) );

// Lets wait 1 second before we try to modify the order again

Sleep ( 1000 );

// Order has not been modified and it has no StopLoss

if ( local_orderstoploss == 0 )

// Try to modify order with a safe hard SL that is 3 pip from current price

local_wasordermodified = OrderModify ( OrderTicket(), 0, NormalizeDouble ( Ask + 30, brokerdigits), 0, 0, Red );

}

}

// Break out from while-loop since the order now has been modified

break;

}

// count 1 more up

local_counter1 ++;

// Break out from switch

break;// We’ve found a matching BUYSTOP-order

case OP_BUYSTOP:

// Price must NOT be larger than indicator in order to modify the order, otherwise the order will be deleted

if ( local_isbidgreaterthanindy == FALSE )

{

// Calculate how much Price, SL and TP should be modified

local_orderprice = sub_normalizebrokerdigits(local_ask + stoplevel + AddPriceGap);

local_orderstoploss = sub_normalizebrokerdigits ( local_orderprice – local_spread – StopLoss * Point – AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_orderprice + Commission + TakeProfit * Point + AddPriceGap );

// Start endless loop

while ( TRUE )

{

// Ok to modify the order if price+stoplevel is less than orderprice AND orderprice-price-stoplevel is greater than trailingstart

if ( local_orderprice < OrderOpenPrice() && OrderOpenPrice() – local_orderprice > TrailingStart )

{// Send an OrderModify command with adjusted Price, SL and TP

if ( local_orderstoploss != OrderStopLoss() && local_ordertakeprofit != OrderTakeProfit() )

{

RefreshRates();

// Start execution timer

execution = GetTickCount();

local_wasordermodified = OrderModify ( OrderTicket(), local_orderprice, local_orderstoploss, local_ordertakeprofit, 0, Lime );

}

// Order was modified

if ( local_wasordermodified == TRUE )

{

// Calculate execution speed

execution = GetTickCount() – execution;

// Print if debug or verbose

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

}

// Order was not modified

else

{

// Reset execution counter

execution = -1;

// Add to errors

sub_errormessages();

}

}

// Break out from endless loop

break;

}

// Increase counter

local_counter1 ++;

}

// Price was larger than the indicator

else

// Delete the order

local_select = OrderDelete ( OrderTicket() );

// Break out from switch

break;// We’ve found a matching SELLSTOP-order

case OP_SELLSTOP:

// Price must be larger than the indicator in order to modify the order, otherwise the order will be deleted

if ( local_isbidgreaterthanindy == TRUE )

{

// Calculate how much Price, SL and TP should be modified

local_orderprice = sub_normalizebrokerdigits ( local_bid – stoplevel – AddPriceGap );

local_orderstoploss = sub_normalizebrokerdigits ( local_orderprice + local_spread + StopLoss * Point + AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_orderprice – Commission – TakeProfit * Point – AddPriceGap );

// Endless loop

while ( TRUE )

{

// Ok to modify order if price-stoplevel is greater than orderprice AND price-stoplevel-orderprice is greater than trailingstart

if (local_orderprice > OrderOpenPrice() && local_orderprice – OrderOpenPrice() > TrailingStart)

{

// Send an OrderModify command with adjusted Price, SL and TP

if(local_orderstoploss != OrderStopLoss() && local_ordertakeprofit != OrderTakeProfit())

{

RefreshRates();

// Start execution counter

execution = GetTickCount();

local_wasordermodified = OrderModify ( OrderTicket(), local_orderprice, local_orderstoploss, local_ordertakeprofit, 0, Orange );

}

// Order was modified

if ( local_wasordermodified == TRUE )

{

// Calculate execution speed

execution = GetTickCount() – execution;

// Print if debug or verbose

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

}

// Order was not modified

else

{

// Reset execution counter

execution = -1;

// Add to errors

sub_errormessages();

}

}

// Break out from endless loop

break;

}

// count 1 more up

local_counter1 ++;

}

// Price was NOT larger than the indicator, so delete the order

else

local_select = OrderDelete ( OrderTicket() );

} // end of switch

} // end if OrderMagicNumber

} // end for loopcount2 – end of loop through open orders// Calculate and keep track on global error number

if ( globalerror >= 0 || globalerror == -2 )

{

local_bidpart = NormalizeDouble ( local_bid / Point, 0 );

local_askpart = NormalizeDouble ( local_ask / Point, 0 );

if ( local_bidpart % 10 != 0 || local_askpart % 10 != 0 )

globalerror = -1;

else

{

if ( globalerror >= 0 && globalerror < 10 )

globalerror ++;

else

globalerror = -2;

}

}// Reset error-variable

local_ordersenderror = FALSE;// Before executing new orders, lets check the average execution time.

if ( local_pricedirection != 0 && MaxExecution > 0 && avg_execution > MaxExecution )

{

local_pricedirection = 0; // Ignore the order opening triger

if ( Debug || Verbose )

Print ( “Server is too Slow. Average Execution: ” + avg_execution );

}// Set default price adjustment

local_askplusdistance = local_ask + stoplevel;

local_bidminusdistance = local_bid – stoplevel;// If we have no open orders AND a price breakout AND average spread is less or equal to max allowed spread AND we have no errors THEN proceed

if ( local_counter1 == 0 && local_pricedirection != 0 && sub_normalizebrokerdigits ( local_realavgspread) <= sub_normalizebrokerdigits ( MaxSpread * Point ) && globalerror == -1 )

{

// If we have a price breakout downwards (Bearish) then send a BUYSTOP order

if ( local_pricedirection == -1 || local_pricedirection == 2 ) // Send a BUYSTOP

{

// Calculate a new price to use

local_orderprice = local_ask + stoplevel;

// SL and TP is not sent with order, but added afterwords in a OrderModify command

if ( ECN_Mode == TRUE )

{

// Set prices for OrderModify of BUYSTOP order

local_orderprice = local_askplusdistance;

local_orderstoploss = 0;

local_ordertakeprofit = 0;

// Start execution counter

execution = GetTickCount();

// Send a BUYSTOP order without SL and TP

local_orderticket = OrderSend ( Symbol(), OP_BUYSTOP, lotsize, local_orderprice, Slippage, local_orderstoploss, local_ordertakeprofit, OrderCmt, Magic, 0, Lime );

// OrderSend was executed successfully

if ( local_orderticket > 0 )

{

// Calculate execution speed

execution = GetTickCount() – execution;

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

// If we have choosen to take snapshots and we’re not backtesting, then do so

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

} // end if ordersend

// OrderSend was NOT executed

else

{

local_ordersenderror = TRUE;

execution = -1;

// Add to errors

sub_errormessages();

}

// OrderSend was executed successfully, so now modify it with SL and TP

if ( OrderSelect ( local_orderticket, SELECT_BY_TICKET ) )

{

RefreshRates();

// Set prices for OrderModify of BUYSTOP order

local_orderprice = OrderOpenPrice();

local_orderstoploss = sub_normalizebrokerdigits ( local_orderprice – local_spread – StopLoss * Point – AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_orderprice + TakeProfit * Point + AddPriceGap );

// Start execution timer

execution = GetTickCount();

// Send a modify order for BUYSTOP order with new SL and TP

local_wasordermodified = OrderModify ( OrderTicket(), local_orderprice, local_orderstoploss, local_ordertakeprofit, local_orderexpiretime, Lime );

// OrderModify was executed successfully

if ( local_wasordermodified == TRUE )

{

// Calculate execution speed

execution = GetTickCount() – execution;

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

// If we have choosen to take snapshots and we’re not backtesting, then do so

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

} // end successful ordermodiify

// Order was NOT modified

else

{

local_ordersenderror = TRUE;

execution = -1;

// Add to errors

sub_errormessages();

} // end if-else

} // end if ordermodify

} // end if ECN_Mode// No ECN-mode, SL and TP can be sent directly

else

{

RefreshRates();

// Set prices for BUYSTOP order

local_orderprice = local_askplusdistance;//ask+stoplevel

local_orderstoploss = sub_normalizebrokerdigits ( local_orderprice – local_spread – StopLoss * Point – AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_orderprice + TakeProfit * Point + AddPriceGap );

// Start execution counter

execution = GetTickCount();

// Send a BUYSTOP order with SL and TP

local_orderticket = OrderSend ( Symbol(), OP_BUYSTOP, lotsize, local_orderprice, Slippage, local_orderstoploss, local_ordertakeprofit, OrderCmt, Magic, local_orderexpiretime, Lime );

if ( local_orderticket > 0 ) // OrderSend was executed suxxessfully

{

// Calculate execution speed

execution = GetTickCount() – execution;

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

// If we have choosen to take snapshots and we’re not backtesting, then do so

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

} // end successful ordersend

// Order was NOT sent

else

{

local_ordersenderror = TRUE;

// Reset execution timer

execution = -1;

// Add to errors

sub_errormessages();

} // end if-else

} // end no ECN-mode

} // end if local_pricedirection == -1 or 2// If we have a price breakout upwards (Bullish) then send a SELLSTOP order

if ( local_pricedirection == 1 || local_pricedirection == 2 )

{

// Set prices for SELLSTOP order with zero SL and TP

local_orderprice = local_bidminusdistance;

local_orderstoploss = 0;

local_ordertakeprofit = 0;

// SL and TP cannot be sent with order, but must be sent afterwords in a modify command

if (ECN_Mode)

{

// Start execution timer

execution = GetTickCount();

// Send a SELLSTOP order without SL and TP

local_orderticket = OrderSend ( Symbol(), OP_SELLSTOP, lotsize, local_orderprice, Slippage, local_orderstoploss, local_ordertakeprofit, OrderCmt, Magic, 0, Orange );

// OrderSend was executed successfully

if ( local_orderticket > 0 )

{

// Calculate execution speed

execution = GetTickCount() – execution;

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

// If we have choosen to take snapshots and we’re not backtesting, then do so

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

} // end if ordersend

// OrderSend was NOT executed

else

{

local_ordersenderror = TRUE;

execution = -1;

// Add to errors

sub_errormessages();

}

// If the SELLSTOP order was executed successfully, then select that order

if ( OrderSelect(local_orderticket, SELECT_BY_TICKET ) )

{

RefreshRates();

// Set prices for SELLSTOP order with modified SL and TP

local_orderprice = OrderOpenPrice();

local_orderstoploss = sub_normalizebrokerdigits ( local_orderprice + local_spread + StopLoss * Point + AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_orderprice – TakeProfit * Point – AddPriceGap );

// Start execution timer

execution = GetTickCount();

// Send a modify order with adjusted SL and TP

local_wasordermodified = OrderModify ( OrderTicket(), OrderOpenPrice(), local_orderstoploss, local_ordertakeprofit, local_orderexpiretime, Orange );

}

// OrderModify was executed successfully

if ( local_wasordermodified == TRUE )

{

// Calculate execution speed

execution = GetTickCount() – execution;

// Print debug info

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

// If we have choosen to take snapshots and we’re not backtesting, then do so

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

} // end if ordermodify was executed successfully

// Order was NOT executed

else

{

local_ordersenderror = TRUE;

// Reset execution timer

execution = -1;

// Add to errors

sub_errormessages();

}

}

else // No ECN-mode, SL and TP can be sent directly

{

RefreshRates();

// Set prices for SELLSTOP order with SL and TP

local_orderprice = local_bidminusdistance;

local_orderstoploss = sub_normalizebrokerdigits ( local_orderprice + local_spread + StopLoss * Point + AddPriceGap );

local_ordertakeprofit = sub_normalizebrokerdigits ( local_orderprice – TakeProfit * Point – AddPriceGap );

// Start execution timer

execution = GetTickCount();

// Send a SELLSTOP order with SL and TP

local_orderticket = OrderSend ( Symbol(), OP_SELLSTOP, lotsize, local_orderprice, Slippage, local_orderstoploss, local_ordertakeprofit, OrderCmt, Magic, local_orderexpiretime, Orange );

// If OrderSend was executed successfully

if ( local_orderticket > 0 )

{

// Calculate exection speed for that order

execution = GetTickCount() – execution;

// Print debug info

if ( Debug || Verbose )

Print ( “Order executed in ” + execution + ” ms” );

if ( TakeShots && !IsTesting() )

sub_takesnapshot();

} // end successful ordersend

// OrderSend was NOT executed successfully

else

{

local_ordersenderror = TRUE;

// Nullify execution timer

execution = 0;

// Add to errors

sub_errormessages();

} // end if-else

} // end no ECN-mode

} // end local_pricedirection == 0 or 2

} // end if execute new orders// If we have no samples, every MaxExecutionMinutes a new OrderModify execution test is done

if ( MaxExecution && execution == -1 && ( TimeLocal() – starttime ) % MaxExecutionMinutes == 0 )

{

// When backtesting, simulate random execution time based on the setting

if ( IsTesting() && MaxExecution )

{

MathSrand ( TimeLocal( ));

execution = MathRand() / ( 32767 / MaxExecution );

}

else

{

// Unless backtesting, lets send a fake order to check the OrderModify execution time,

if ( IsTesting() == FALSE )

{

// To be sure that the fake order never is executed, st the price to twice the current price

local_fakeprice = local_ask * 2.0;

// Send a BUYSTOP order

local_orderticket = OrderSend ( Symbol(), OP_BUYSTOP, lotsize, local_fakeprice, Slippage, 0, 0, OrderCmt, Magic, 0, Lime );

execution = GetTickCount();

// Send a modify command where we adjust the price with +1 pip

local_wasordermodified = OrderModify ( local_orderticket, local_fakeprice + 10 * Point, 0, 0, 0, Lime );

// Calculate execution speed

execution = GetTickCount() – execution;

// Delete the order

local_select = OrderDelete(local_orderticket);

}

}

}// Do we have a valid execution sample? Update the average execution time.

if ( execution >= 0 )

{

// Consider only 10 samples at most.

if ( execution_samples < 10 )

execution_samples ++;

// Calculate average execution speed

avg_execution = avg_execution + ( execution – avg_execution ) / execution_samples;

}// Check initialization

if ( globalerror >= 0 )

Comment ( “Robot is initializing…” );

else

{

// Error

if ( globalerror == -2 )

Comment ( “ERROR — Instrument ” + Symbol() + ” prices should have ” + brokerdigits + ” fraction digits on broker account” );

// No errors, ready to print

else

{

local_textstring = TimeToStr ( TimeCurrent() ) + ” Tick: ” + sub_adjust00instring ( tickcounter );

// Only show / print this if Debug OR Verbose are set to TRUE

if ( Debug || Verbose )

{

local_textstring = local_textstring + “\n*** DEBUG MODE *** \nCurrency pair: ” + Symbol() + “, Volatility: ” + sub_dbl2strbrokerdigits ( local_volatility )

+ “, VolatilityLimit: ” + sub_dbl2strbrokerdigits ( VolatilityLimit ) + “, VolatilityPercentage: ” + sub_dbl2strbrokerdigits ( local_volatilitypercentage );

local_textstring = local_textstring + “\nPriceDirection: ” + StringSubstr ( “BUY NULLSELLBOTH”, 4 * local_pricedirection + 4, 4 ) + “, Expire: ”

+ TimeToStr ( local_orderexpiretime, TIME_MINUTES ) + “, Open orders: ” + local_counter1;

local_textstring = local_textstring + “\nBid: ” + sub_dbl2strbrokerdigits ( local_bid ) + “, Ask: ” + sub_dbl2strbrokerdigits ( local_ask ) + “, ” + local_indy;

local_textstring = local_textstring + “\nAvgSpread: ” + sub_dbl2strbrokerdigits ( local_avgspread ) + “, RealAvgSpread: ” + sub_dbl2strbrokerdigits ( local_realavgspread )

+ “, Commission: ” + sub_dbl2strbrokerdigits ( Commission ) + “, Lots: ” + DoubleToStr ( lotsize, 2 ) + “, Execution: ” + execution + ” ms”;

if ( sub_normalizebrokerdigits ( local_realavgspread ) > sub_normalizebrokerdigits ( MaxSpread * Point ) )

{

local_textstring = local_textstring + “\n” + “The current spread (” + sub_dbl2strbrokerdigits ( local_realavgspread )

+”) is higher than what has been set as MaxSpread (” + sub_dbl2strbrokerdigits ( MaxSpread * Point ) + “) so no trading is allowed right now on this currency pair!”;

}

if ( MaxExecution > 0 && avg_execution > MaxExecution )

{

local_textstring = local_textstring + “\n” + “The current Avg Execution (” + avg_execution +”) is higher than what has been set as MaxExecution (”

+ MaxExecution+ ” ms), so no trading is allowed right now on this currency pair!”;

}

Comment ( local_textstring );

// Only print this if we have a any orders OR have a price breakout OR Verbode mode is set to TRUE

if ( local_counter1 != 0 || local_pricedirection != 0 )

sub_printformattedstring ( local_textstring );

}

} // end if-else

} // end check initialization// Check for stray market orders without SL

sub_Check4StrayTrades();} // end sub

void sub_Check4StrayTrades()

{

int local_loop;

int local_totals;

bool local_modified = TRUE;

bool local_selected;

double local_ordersl;

double local_newsl;// New SL to use for modifying stray market orders is max of either current SL or 10 points

local_newsl = MathMax ( StopLoss, 10 );

// Get number of open orders

local_totals = OrdersTotal();// Loop through all open orders from first to last

for ( local_loop = 0; local_loop < local_totals; local_loop ++ )

{

// Select on order

if ( OrderSelect ( local_loop, SELECT_BY_POS, MODE_TRADES ) )

{

// Check if it matches the MagicNumber and chart symbol

if ( OrderMagicNumber() == Magic && OrderSymbol() == Symbol() ) // If the orders are for this EA

{

local_ordersl = OrderStopLoss();

// Continue as long as the SL for the order is 0.0

while ( local_ordersl == 0.0 )

{

if ( OrderType() == OP_BUY )

{

// Set new SL 10 points away from current price

local_newsl = Bid – local_newsl * Point;

local_modified = OrderModify ( OrderTicket(), OrderOpenPrice(), NormalizeDouble ( local_newsl, Digits ), OrderTakeProfit(), 0, Blue );

}

else if ( OrderType() == OP_SELL )

{

// Set new SL 10 points away from current price

local_newsl = Ask + local_newsl * Point;

local_modified = OrderModify ( OrderTicket(), OrderOpenPrice(), NormalizeDouble ( local_newsl, Digits ), OrderTakeProfit(), 0, Blue );

} // If the order without previous SL was modified wit a new SL

if ( local_modified == TRUE )

{

// Select that modified order, set while condition variable to that true value and exit while-loop

local_selected = OrderSelect ( local_modified, SELECT_BY_TICKET, MODE_TRADES );

local_ordersl = OrderStopLoss();

break;

}

// If the order could not be modified

else // if ( local_modified == FALSE )

{

// Wait 1/10 second and then fetch new prices

Sleep ( 100 );

RefreshRates();

// Print debug info

if ( Debug || Verbose )

Print ( “Error trying to modify stray order with a SL!” );

// Add to errors

sub_errormessages();

}

}

}

}

}

}// Convert a decimal number to a text string

string sub_dbl2strbrokerdigits ( double par_a )

{

return ( DoubleToStr ( par_a, brokerdigits ) );

}// Adjust numbers with as many decimals as the broker uses

double sub_normalizebrokerdigits ( double par_a )

{

return ( NormalizeDouble ( par_a, brokerdigits ) );

}// Adjust textstring with zeros at the end

string sub_adjust00instring ( int par_a )

{

if ( par_a < 10 )

return ( “00” + par_a );

if ( par_a < 100 )

return ( “0” + par_a );

return ( “” + par_a );

}// Print out formatted textstring

void sub_printformattedstring ( string par_a )

{

int local_difference;

int local_a = -1;while ( local_a < StringLen ( par_a ) )

{

local_difference = local_a + 1;

local_a = StringFind ( par_a, “\n”, local_difference );

if ( local_a == -1 )

{

Print ( StringSubstr ( par_a, local_difference ) );

return;

}

Print ( StringSubstr ( par_a, local_difference, local_a – local_difference ) );

}

}double sub_multiplicator()

{

// Calculate lot multiplicator for Account Currency. Assumes that account currency is any of the 8 majors.

// If the account currency is of any other currency, then calculate the multiplicator as follows:

// If base-currency is USD then use the BID-price for the currency pair USDXXX; or if the

// counter currency is USD the use 1 / BID-price for the currency pair XXXUSD,

// where XXX is the abbreviation for the account currency. The calculated lot-size should

// then be multiplied with this multiplicator.

double multiplicator = 1.0;

int length;

string appendix = “”;if ( AccountCurrency() == “USD” )

return ( multiplicator );

length = StringLen ( Symbol() );

if ( length != 6 )

appendix = StringSubstr ( Symbol(), 6, length – 6 );

if ( AccountCurrency() == “EUR” )

multiplicator = 1.0 / MarketInfo ( “EURUSD” + appendix, MODE_BID );

if ( AccountCurrency() == “GBP” )

multiplicator = 1.0 / MarketInfo ( “GBPUSD” + appendix, MODE_BID );

if ( AccountCurrency() == “AUD” )

multiplicator = 1.0 / MarketInfo ( “AUDUSD” + appendix, MODE_BID );

if ( AccountCurrency() == “NZD” )

multiplicator = 1.0 / MarketInfo ( “NZDUSD” + appendix, MODE_BID );

if ( AccountCurrency() == “CHF” )

multiplicator = MarketInfo ( “USDCHF” + appendix, MODE_BID );

if ( AccountCurrency() == “JPY” )

multiplicator = MarketInfo ( “USDJPY” + appendix, MODE_BID );

if ( AccountCurrency() == “CAD” )

multiplicator = MarketInfo ( “USDCAD” + appendix, MODE_BID );

if ( multiplicator == 0 )

multiplicator = 1.0; // If account currency is neither of EUR, GBP, AUD, NZD, CHF, JPY or CAD we assumes that it is USD

return ( multiplicator );

}// Magic Number – calculated from a sum of account number + ASCII-codes from currency pair

int sub_magicnumber ()

{

string local_a;

string local_b;

int local_c;

int local_d;

int local_i;

string local_par = “EURUSDJPYCHFCADAUDNZDGBP”;

string local_sym = Symbol();local_a = StringSubstr (local_sym, 0, 3);

local_b = StringSubstr (local_sym, 3, 3);

local_c = StringFind (local_par, local_a, 0);

local_d = StringFind (local_par, local_b, 0);

local_i = 999999999 – AccountNumber() – local_c – local_d;

if ( Debug == TRUE )

Print ( “MagicNumber: “, local_i );

return ( local_i );

}// Main routine for making a screenshoot / printscreen

void sub_takesnapshot()

{

static datetime local_lastbar;

static int local_doshot = -1;

static int local_oldphase = 3000000;

int local_shotinterval;

int local_phase;if ( ShotsPerBar > 0 )

local_shotinterval = MathRound ( ( 60 * Period() ) / ShotsPerBar );

else

local_shotinterval = 60 * Period();

local_phase = MathFloor ( ( CurTime() – Time[0] ) / local_shotinterval );if ( Time[0] != local_lastbar )

{

local_lastbar = Time[0];

local_doshot = DelayTicks;

}

else if ( local_phase > local_oldphase )

sub_makescreenshot ( “i” );local_oldphase = local_phase;

if ( local_doshot == 0 )

sub_makescreenshot ( “” );

if ( local_doshot >= 0 )

local_doshot -= 1;

}// add leading zeros that the resulting string has ‘digits’ length.

string sub_maketimestring ( int par_number, int par_digits )

{

string local_result;local_result = DoubleToStr ( par_number, 0 );

while ( StringLen ( local_result ) < par_digits )

local_result = “0” + local_result;return ( local_result );

}// Make a screenshoot / printscreen

void sub_makescreenshot ( string par_sx = “” )

{

static int local_no = 0;local_no ++;

string fn = “SnapShot” + Symbol() + Period() + “\\”+Year() + “-” + sub_maketimestring ( Month(), 2 ) + “-” + sub_maketimestring ( Day(), 2 )

+ ” ” + sub_maketimestring ( Hour(), 2 ) + “_” + sub_maketimestring ( Minute(), 2 ) + “_” + sub_maketimestring ( Seconds( ), 2 ) + ” ” + local_no + par_sx + “.gif”;

if ( !ScreenShot ( fn, 640, 480 ) )

Print ( “ScreenShot error: “, ErrorDescription ( GetLastError() ) );

}// Calculate lotsize based on Equity, Risk (in %) and StopLoss in points

double sub_calculatelotsize()

{

string local_textstring;

double local_availablemoney;

double local_lotsize;

double local_maxlot;

double local_minlot;int local_lotdigit;

if ( lotstep == 1)

local_lotdigit = 0;

if ( lotstep == 0.1 )

local_lotdigit = 1;

if ( lotstep == 0.01 )

local_lotdigit = 2;// Get available money as Equity

local_availablemoney = AccountEquity();

// Maximum allowed Lot by the broker according to Equity. And we don’t use 100% but 98%

local_maxlot = MathMin ( MathFloor ( local_availablemoney * 0.98 / marginforonelot / lotstep ) * lotstep, MaxLots );

// Minimum allowed Lot by the broker

local_minlot = MinLots;

// Lot according to Risk. Don’t use 100% but 98% (= 102) to avoid

local_lotsize = MathMin(MathFloor ( Risk / 102 * local_availablemoney / ( StopLoss + AddPriceGap ) / lotstep ) * lotstep, MaxLots );

local_lotsize = local_lotsize * sub_multiplicator();

local_lotsize = NormalizeDouble ( local_lotsize, local_lotdigit );// Empty textstring

local_textstring = “”;// Use manual fix lotsize, but if necessary adjust to within limits

if ( MoneyManagement == FALSE )

{

// Set lotsize to manual lotsize

local_lotsize = ManualLotsize;

// Check if ManualLotsize is greater than allowed lotsize

if ( ManualLotsize > local_maxlot )

{

local_lotsize = local_maxlot;

local_textstring = “Note: Manual lotsize is too high. It has been recalculated to maximum allowed ” + DoubleToStr ( local_maxlot, 2 );

Print ( local_textstring );

Comment ( local_textstring );

ManualLotsize = local_maxlot;

}

else if ( ManualLotsize < local_minlot )

local_lotsize = local_minlot;

}

return ( local_lotsize );

}// Re-calculate a new Risk if the current one is too low or too high

void sub_recalculatewrongrisk()

{

string local_textstring;

double local_availablemoney;

double local_maxlot;

double local_minlot;

double local_maxrisk;

double local_minrisk;// Get available amount of money as Equity

local_availablemoney = AccountEquity();

// Maximum allowed Lot by the broker according to Equity

local_maxlot = MathFloor ( local_availablemoney / marginforonelot / lotstep ) * lotstep;

// Maximum allowed Risk by the broker according to maximul allowed Lot and Equity

local_maxrisk = MathFloor ( local_maxlot * ( stoplevel + StopLoss ) / local_availablemoney * 100 / 0.1 ) * 0.1;

// Minimum allowed Lot by the broker

local_minlot = MinLots;

// Minimum allowed Risk by the broker according to minlots_broker

local_minrisk = MathRound ( local_minlot * StopLoss / local_availablemoney * 100 / 0.1 ) * 0.1;

// Empty textstring

local_textstring = “”;if ( MoneyManagement == TRUE )

{

// If Risk% is greater than the maximum risklevel the broker accept, then adjust Risk accordingly and print out changes

if ( Risk > local_maxrisk )

{

local_textstring = local_textstring + “Note: Risk has manually been set to ” + DoubleToStr ( Risk, 1 ) + ” but cannot be higher than ” + DoubleToStr ( local_maxrisk, 1 ) + ” according to “;

local_textstring = local_textstring + “the broker, StopLoss and Equity. It has now been adjusted accordingly to ” + DoubleToStr ( local_maxrisk, 1 ) + “%”;

Risk = local_maxrisk;

sub_printandcomment ( local_textstring );

}

// If Risk% is less than the minimum risklevel the broker accept, then adjust Risk accordingly and print out changes

if (Risk < local_minrisk)

{

local_textstring = local_textstring + “Note: Risk has manually been set to ” + DoubleToStr ( Risk, 1 ) + ” but cannot be lower than ” + DoubleToStr ( local_minrisk, 1 ) + ” according to “;

local_textstring = local_textstring + “the broker, StopLoss, AddPriceGap and Equity. It has now been adjusted accordingly to ” + DoubleToStr ( local_minrisk, 1 ) + “%”;

Risk = local_minrisk;

sub_printandcomment ( local_textstring );

}

}

// Don’t use MoneyManagement, use fixed manual lotsize

else // MoneyManagement == FALSE

{

// Check and if necessary adjust manual lotsize to external limits

if ( ManualLotsize < MinLots )

{

local_textstring = “Manual lotsize ” + DoubleToStr ( ManualLotsize, 2 ) + ” cannot be less than ” + DoubleToStr ( MinLots, 2 ) + “. It has now been adjusted to ” + DoubleToStr ( MinLots, 2);

ManualLotsize = MinLots;

sub_printandcomment ( local_textstring );

}

if ( ManualLotsize > MaxLots )

{

local_textstring = “Manual lotsize ” + DoubleToStr ( ManualLotsize, 2 ) + ” cannot be greater than ” + DoubleToStr ( MaxLots, 2 ) + “. It has now been adjusted to ” + DoubleToStr ( MinLots, 2 );

ManualLotsize = MaxLots;

sub_printandcomment ( local_textstring );

}

// Check to see that manual lotsize does not exceeds maximum allowed lotsize

if ( ManualLotsize > local_maxlot )

{

local_textstring = “Manual lotsize ” + DoubleToStr ( ManualLotsize, 2 ) + ” cannot be greater than maximum allowed lotsize. It has now been adjusted to ” + DoubleToStr ( local_maxlot, 2 );

ManualLotsize = local_maxlot;

sub_printandcomment ( local_textstring );

}

}

}// Print out broker details and other info

void sub_printdetails()

{

string local_margintext;

string local_stopouttext;

string local_fixedlots;

int local_type;

int local_freemarginmode;

int local_stopoutmode;

double local_newsl;local_newsl = MathMax ( StopLoss, 10 );

local_type = IsDemo() + IsTesting();

local_freemarginmode = AccountFreeMarginMode();

local_stopoutmode = AccountStopoutMode();if ( local_freemarginmode == 0 )

local_margintext = “that floating profit/loss is not used for calculation.”;

else if ( local_freemarginmode == 1 )

local_margintext = “both floating profit and loss on open positions.”;

else if ( local_freemarginmode == 2 )

local_margintext = “only profitable values, where current loss on open positions are not included.”;

else if ( local_freemarginmode == 3 )

local_margintext = “only loss values are used for calculation, where current profitable open positions are not included.”;if ( local_stopoutmode == 0 )

local_stopouttext = “percentage ratio between margin and equity.”;

else if ( local_stopoutmode == 1 )

local_stopouttext = “comparison of the free margin level to the absolute value.”;if ( MoneyManagement == TRUE )

local_fixedlots = ” (automatically calculated lots).”;

if ( MoneyManagement == FALSE )

local_fixedlots = ” (fixed manual lots).”;Print ( “Broker name: “, AccountCompany() );

Print ( “Broker server: “, AccountServer() );

Print ( “Account type: “, StringSubstr ( “RealDemoTest”, 4 * local_type, 4) );

Print ( “Initial account equity: “, AccountEquity(),” “, AccountCurrency() );

Print ( “Broker digits: “, brokerdigits);

Print ( “Broker stoplevel / freezelevel (max): “, stoplevel );

Print ( “Broker stopout level: “, stopout, “%” );

Print ( “Broker Point: “, DoubleToStr ( Point, brokerdigits ),” on “, AccountCurrency() );

Print ( “Broker account leverage in percentage: “, leverage );

Print ( “Broker credit value on the account: “, AccountCredit() );

Print ( “Broker account margin: “, AccountMargin() );

Print ( “Broker calculation of free margin allowed to open positions considers ” + local_margintext );

Print ( “Broker calculates stopout level as ” + local_stopouttext );

Print ( “Broker requires at least “, marginforonelot,” “, AccountCurrency(),” in margin for 1 lot.” );

Print ( “Broker set 1 lot to trade “, lotbase,” “, AccountCurrency() );

Print ( “Broker minimum allowed lotsize: “, MinLots );

Print ( “Broker maximum allowed lotsize: “, MaxLots );

Print ( “Broker allow lots to be resized in “, lotstep, ” steps.” );

Print ( “Risk: “, Risk, “%” );

Print ( “Risk adjusted lotsize: “, DoubleToStr ( lotsize, 2 ) + local_fixedlots );

}// Print and show comment of text

void sub_printandcomment ( string par_text )

{

Print ( par_text );

Comment ( par_text );

}// Summarize error messages that comes from the broker server

void sub_errormessages()

{

int local_error = GetLastError();switch ( local_error )

{

// Unchanged values

case 1: // ERR_SERVER_BUSY:

{

err_unchangedvalues ++;

break;

}

// Trade server is busy

case 4: // ERR_SERVER_BUSY:

{

err_busyserver ++;

break;

}

case 6: // ERR_NO_CONNECTION:

{

err_lostconnection ++;

break;

}

case 8: // ERR_TOO_FREQUENT_REQUESTS:

{

err_toomanyrequest ++;

break;

}

case 129: // ERR_INVALID_PRICE:

{

err_invalidprice ++;

break;

}

case 130: // ERR_INVALID_STOPS:

{

err_invalidstops ++;

break;

}

case 131: // ERR_INVALID_TRADE_VOLUME:

{

err_invalidtradevolume ++;

break;

}

case 135: // ERR_PRICE_CHANGED:

{

err_pricechange ++;

break;

}

case 137: // ERR_BROKER_BUSY:

{

err_brokerbuzy ++;

break;

}

case 138: // ERR_REQUOTE:

{

err_requotes ++;

break;

}

case 141: // ERR_TOO_MANY_REQUESTS:

{

err_toomanyrequests ++;

break;

}

case 145: // ERR_TRADE_MODIFY_DENIED:

{

err_trademodifydenied ++;

break;

}

case 146: // ERR_TRADE_CONTEXT_BUSY:

{

err_tradecontextbuzy ++;

break;

}

}

}// Print out and comment summarized messages from the broker

void sub_printsumofbrokererrors()

{

string local_txt;

int local_totalerrors;local_txt = “Number of times the brokers server reported that “;

local_totalerrors = err_unchangedvalues + err_busyserver + err_lostconnection + err_toomanyrequest + err_invalidprice

+ err_invalidstops + err_invalidtradevolume + err_pricechange + err_brokerbuzy + err_requotes + err_toomanyrequests

+ err_trademodifydenied + err_tradecontextbuzy;if ( err_unchangedvalues > 0 )

sub_printandcomment ( local_txt + “SL and TP was modified to existing values: ” + DoubleToStr ( err_unchangedvalues, 0 ) );

if ( err_busyserver > 0 )

sub_printandcomment ( local_txt + “it is buzy: ” + DoubleToStr ( err_busyserver, 0 ) );

if ( err_lostconnection > 0 )

sub_printandcomment ( local_txt + “the connection is lost: ” + DoubleToStr ( err_lostconnection, 0 ) );

if ( err_toomanyrequest > 0 )

sub_printandcomment ( local_txt + “there was too many requests: ” + DoubleToStr ( err_toomanyrequest, 0 ) );

if ( err_invalidprice > 0 )

sub_printandcomment ( local_txt + “the price was invalid: ” + DoubleToStr ( err_invalidprice, 0 ) );

if ( err_invalidstops > 0 )

sub_printandcomment ( local_txt + “invalid SL and/or TP: ” + DoubleToStr ( err_invalidstops, 0 ) );

if ( err_invalidtradevolume > 0 )

sub_printandcomment ( local_txt + “invalid lot size: ” + DoubleToStr ( err_invalidtradevolume, 0 ) );

if ( err_pricechange > 0 )

sub_printandcomment(local_txt + “the price has changed: ” + DoubleToStr ( err_pricechange, 0 ) );

if ( err_brokerbuzy > 0 )

sub_printandcomment(local_txt + “the broker is buzy: ” + DoubleToStr ( err_brokerbuzy, 0 ) ) ;

if ( err_requotes > 0 )

sub_printandcomment ( local_txt + “requotes ” + DoubleToStr ( err_requotes, 0 ) );

if ( err_toomanyrequests > 0 )

sub_printandcomment ( local_txt + “too many requests ” + DoubleToStr ( err_toomanyrequests, 0 ) );

if ( err_trademodifydenied > 0 )

sub_printandcomment ( local_txt + “modifying orders is denied ” + DoubleToStr ( err_trademodifydenied, 0 ) );

if ( err_tradecontextbuzy > 0)

sub_printandcomment ( local_txt + “trade context is buzy: ” + DoubleToStr ( err_tradecontextbuzy, 0 ) );

if ( local_totalerrors == 0 )

sub_printandcomment ( “There was no error reported from the broker server!” );

}

相关资源

暂无评论...