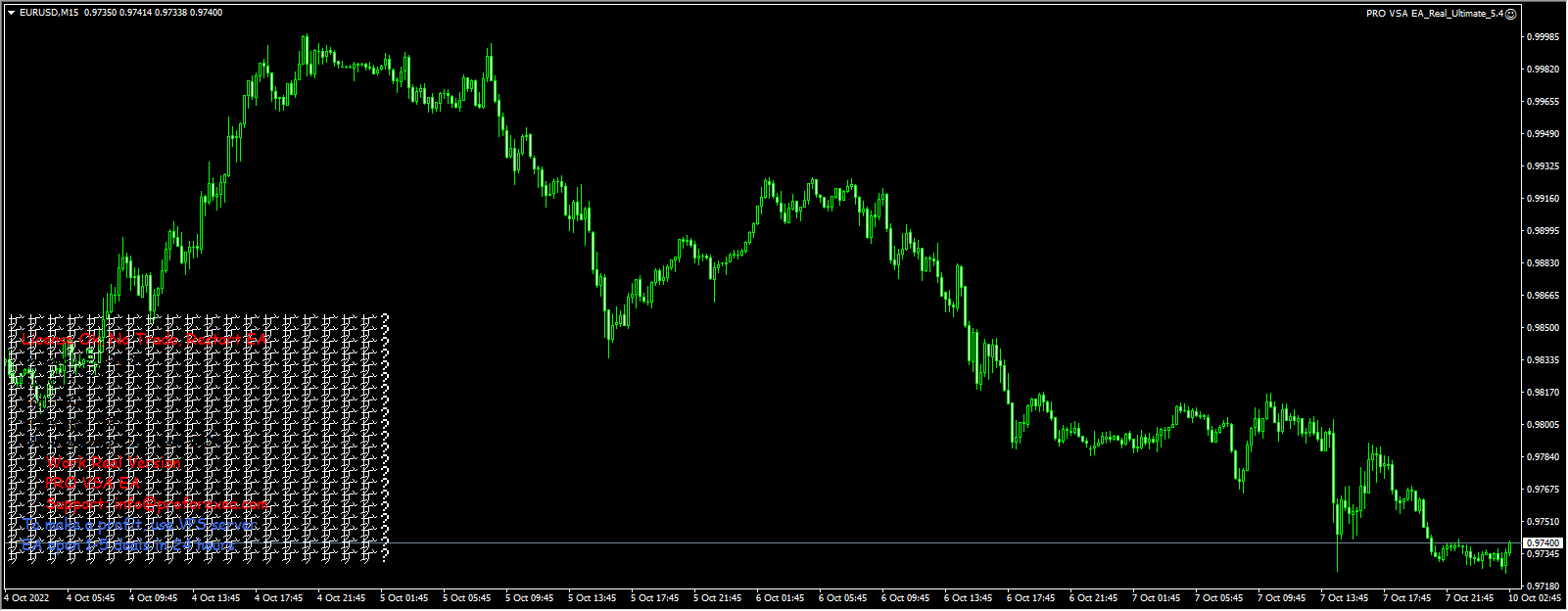

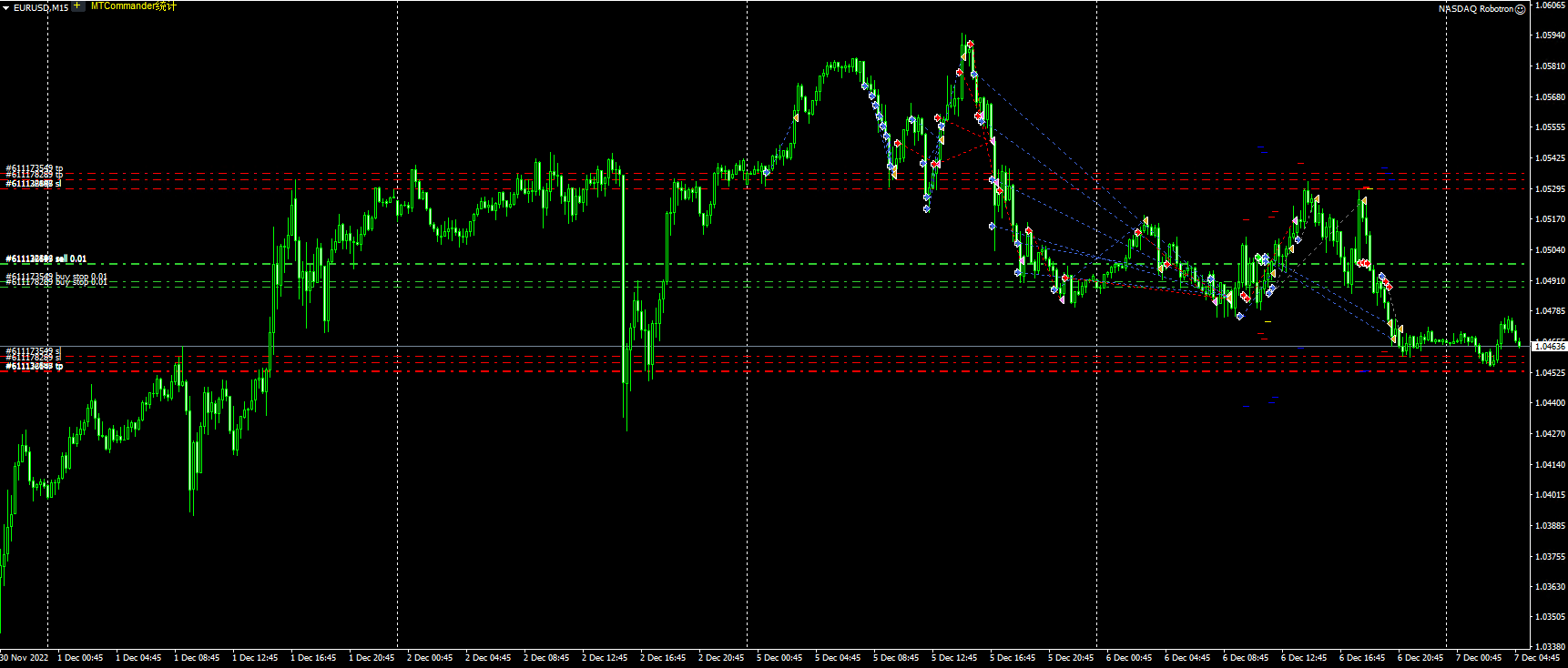

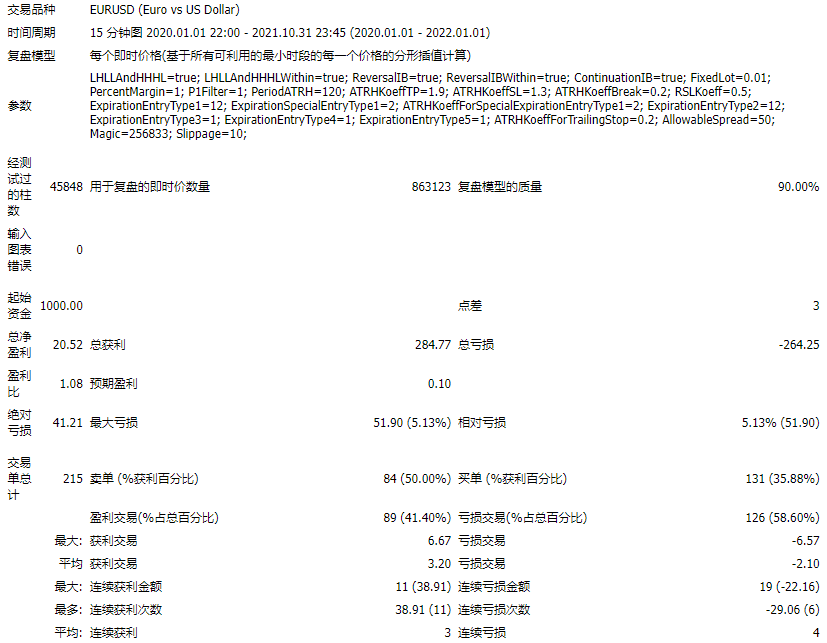

2022-12-17挂机测试

//+——————————————————————+

//| NASDAQ Robotron.mq4 |

//| Copyright 2020, NASDAQ Robotron.

//|

//+——————————————————————+

#property copyright “Copyright 2020, NASDAQ Robotron”

#property link “https://www.mql5.com”

#property version “2.00”

#property strict

input bool LHLLAndHHHL = true;

input bool LHLLAndHHHLWithin = true;

input bool ReversalIB = true;

input bool ReversalIBWithin = true;

input bool ContinuationIB = true;

input double FixedLot = 0.01;

input double PercentMargin = 1.0;

input int P1Filter = 1;

input int PeriodATRH = 120;

input double ATRHKoeffTP = 1.9;

input double ATRHKoeffSL = 1.3;

input double ATRHKoeffBreak = 0.2;

input double RSLKoeff = 0.5;

input int ExpirationEntryType1 = 12;

input int ExpirationSpecialEntryType1 = 2;

input double ATRHKoeffForSpecialExpirationEntryType1 = 2.0;

input int ExpirationEntryType2 = 12;

input int ExpirationEntryType3 = 1;

input int ExpirationEntryType4 = 1;

input int ExpirationEntryType5 = 1;

input double ATRHKoeffForTrailingStop = 0.2;

input int AllowableSpread = 50;

input int Magic = 256833;

input int Slippage = 10;

double stoplevel, freezy, hi, lo;

double ATRH, spread, entry, TP, SL, Break, RSL, RSLT;

datetime expir, LE1_TimeSBar, SE1_TimeSBar, LE3_TimeSBar, SE3_TimeSBar, LE5_TimeSBar, SE5_TimeSBar;

int shiftSBar;

//+——————————————————————+

//| Expert initialization function |

//+——————————————————————+

int OnInit()

{

//—

stoplevel = MarketInfo(_Symbol,MODE_STOPLEVEL);

freezy = MarketInfo(_Symbol,MODE_FREEZELEVEL);

//—

return(INIT_SUCCEEDED);

}

//+——————————————————————+

//| Expert deinitialization function |

//+——————————————————————+

void OnDeinit(const int reason)

{

//—

}

//+——————————————————————+

//| Expert tick function |

//+——————————————————————+

void OnTick()

{

//—

//Movement sl: trailing, breakeven level, reduce risk level

int total = OrdersTotal();

for(int i=0; i<total; i++) {

if(OrderSelect(i,SELECT_BY_POS) && OrderSymbol()==_Symbol && OrderMagicNumber()==Magic) {

int f = StringFind(OrderComment(),”S”);

if(f>=0 && OrderType()==OP_BUY && isHHHL()) {

double spr = StringToDouble(StringSubstr(OrderComment(),f+1));

int bshift = iBarShift(_Symbol,PERIOD_CURRENT,OrderOpenTime(),false);

double highest = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,bshift,0)];

computeForLongDt(bshift+1,spr);

if(highest>=TP) {

double newsl = NormalizeDouble(Low[bshift+2] – ATRH*ATRHKoeffForTrailingStop,_Digits);

if(newsl>OrderStopLoss()) {

Print(“HHHL traling stop for buy (“+DoubleToStr(newsl,_Digits)+”,”+DoubleToStr(OrderStopLoss(),_Digits)+”) [“+DoubleToStr(ATRH,_Digits)+”,”+DoubleToStr(spread,0)+”,”+DoubleToStr(entry,_Digits)+”,”+DoubleToStr(TP,_Digits)+”,”+DoubleToStr(SL,_Digits)+”,”+DoubleToStr(Break,_Digits)+”,”+DoubleToStr(RSL,_Digits)+”,”+DoubleToStr(RSLT,_Digits)+”]”);

modifyBuy(OrderTicket(),OrderOpenPrice(),newsl,OrderTakeProfit(),OrderExpiration()); return;

}

}

}

else if(f>=0 && OrderType()==OP_SELL && isLHLL()) {

double spr = StringToDouble(StringSubstr(OrderComment(),f+1));

int bshift = iBarShift(_Symbol,PERIOD_CURRENT,OrderOpenTime(),false);

double lowest = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,bshift,0)];

computeForShortDt(bshift+1,spr);

if(lowest<=TP) {

double newsl = NormalizeDouble(High[bshift+2] + ATRH*ATRHKoeffForTrailingStop,_Digits);

if(newsl<OrderStopLoss()) {

Print(“LHLL traling stop for sell (“+DoubleToStr(newsl,_Digits)+”,”+DoubleToStr(OrderStopLoss(),_Digits)+”) [“+DoubleToStr(ATRH,_Digits)+”,”+DoubleToStr(spread,0)+”,”+DoubleToStr(entry,_Digits)+”,”+DoubleToStr(TP,_Digits)+”,”+DoubleToStr(SL,_Digits)+”,”+DoubleToStr(Break,_Digits)+”,”+DoubleToStr(RSL,_Digits)+”,”+DoubleToStr(RSLT,_Digits)+”]”);

modifySell(OrderTicket(),OrderOpenPrice(),newsl,OrderTakeProfit(),OrderExpiration()); return;

}

}

}

else if(f>=0 && OrderType()==OP_BUY) {

double spr = StringToDouble(StringSubstr(OrderComment(),f+1));

int bshift = iBarShift(_Symbol,PERIOD_CURRENT,OrderOpenTime(),false);

computeForLongDt(bshift+1,spr);

double newsl = 0.0;

string text = “”;

if(Close[0]>=RSLT) { text = “RSL reduce risk movement stoploss for buy (“; newsl = NormalizeDouble(RSL,_Digits); }

else if(Close[0]>=Break) { text = “Breakeven movement stoploss for buy (“; newsl = OrderOpenPrice(); }

if(newsl>OrderStopLoss()) {

Print(text+DoubleToStr(newsl,_Digits)+”,”+DoubleToStr(OrderStopLoss(),_Digits)+”) [“+DoubleToStr(ATRH,_Digits)+”,”+DoubleToStr(spread,0)+”,”+DoubleToStr(entry,_Digits)+”,”+DoubleToStr(TP,_Digits)+”,”+DoubleToStr(SL,_Digits)+”,”+DoubleToStr(Break,_Digits)+”,”+DoubleToStr(RSL,_Digits)+”,”+DoubleToStr(RSLT,_Digits)+”]”);

modifyBuy(OrderTicket(),OrderOpenPrice(),newsl,OrderTakeProfit(),OrderExpiration()); return;

}

}

else if(f>=0 && OrderType()==OP_SELL) {

double spr = StringToDouble(StringSubstr(OrderComment(),f+1));

int bshift = iBarShift(_Symbol,PERIOD_CURRENT,OrderOpenTime(),false);

computeForShortDt(bshift+1,spr);

double newsl = 0.0;

string text = “”;

if(Close[0]<=RSLT) { text = “RSL reduce risk movement stoploss for sell (“; newsl = NormalizeDouble(RSL,_Digits); }

else if(Close[0]<=Break) { text = “Breakeven movement stoploss for sell (“; newsl = OrderOpenPrice(); }

if(newsl>0.0 && newsl<OrderStopLoss()) {

Print(text+DoubleToStr(newsl,_Digits)+”,”+DoubleToStr(OrderStopLoss(),_Digits)+”) [“+DoubleToStr(ATRH,_Digits)+”,”+DoubleToStr(spread,0)+”,”+DoubleToStr(entry,_Digits)+”,”+DoubleToStr(TP,_Digits)+”,”+DoubleToStr(SL,_Digits)+”,”+DoubleToStr(Break,_Digits)+”,”+DoubleToStr(RSL,_Digits)+”,”+DoubleToStr(RSLT,_Digits)+”]”);

modifySell(OrderTicket(),OrderOpenPrice(),newsl,OrderTakeProfit(),OrderExpiration()); return;

}

}

}

}

//***************************************************************************************

//Long Entry Type2

if(LHLLAndHHHL && LHLLAndHHHLWithin && LE1_TimeSBar>0 && isLHLL() && Low[2]>Low[1] && Low[3]>Low[1] && Low[4]>Low[1] && Low[5]>Low[1]) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,LE1_TimeSBar,false) – 1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

if(shiftSBar>=0 && hi<=High[shiftSBar+1] && lo>=Low[shiftSBar]) {

if(getTicketByComment(“WLHLL”+IntegerToString(Time[1]))==0) {

computeForLong();

expir = TimeCurrent()+ExpirationEntryType2*60*60;

Print(“Place Long Entry Type2”);

buyStop(getLots(), NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits), “WLHLL”+IntegerToString(Time[1]), expir); return;

}

}

}

//Short Entry Type2

if(LHLLAndHHHL && LHLLAndHHHLWithin && SE1_TimeSBar>0 && isHHHL() && High[2]<High[1] && High[3]<High[1] && High[4]<High[1] && High[5]<High[1]) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,SE1_TimeSBar,false) – 1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

if(shiftSBar>=0 && hi<=High[shiftSBar] && lo>=Low[shiftSBar+1]) {

if(getTicketByComment(“WHHHL”+IntegerToString(Time[1]))==0) {

computeForShort();

expir = TimeCurrent()+ExpirationEntryType2*60*60;

Print(“Place Short Entry Type2”);

sellStop(getLots(), NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits), “WHHHL”+IntegerToString(Time[1]), expir); return;

}

}

}

//Long Entry Type1

if(LHLLAndHHHL && isLHLL() && Low[2]>Low[1] && Low[3]>Low[1] && Low[4]>Low[1] && Low[5]>Low[1]) {

if(LE1_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,LE1_TimeSBar,false)-1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

}

if((LE1_TimeSBar==0 || (shiftSBar>=0 && hi>High[shiftSBar+1] && lo<Low[shiftSBar])) && getTicketByComment(“LHLL”+IntegerToString(Time[1]))==0) {

computeForLong();

LE1_TimeSBar = Time[1];

if(High[2]-Low[1]>ATRH*ATRHKoeffForSpecialExpirationEntryType1) expir = TimeCurrent()+ExpirationSpecialEntryType1*60*60;

else expir = TimeCurrent()+ExpirationEntryType1*60*60;

int t = getTicketByComment(“LHLL”);

if(t>0) {

if(OrderSelect(t,SELECT_BY_TICKET) && OrderType()==OP_BUYSTOP) {

bool d = OrderDelete(t,clrSilver);

if(!d) Print(“Error delete order “+IntegerToString(_LastError));

return;

}

}

Print(“Place Long Entry Type1”);

buyStop(getLots(), NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits), “LHLL”+IntegerToString(LE1_TimeSBar)+”S”+DoubleToString(spread,0), expir); return;

}

}

//Short Entry Type1

if(LHLLAndHHHL && isHHHL() && High[2]<High[1] && High[3]<High[1] && High[4]<High[1] && High[5]<High[1]) {

if(SE1_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,SE1_TimeSBar,false)-1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

}

if((SE1_TimeSBar==0 || (shiftSBar>=0 && hi>High[shiftSBar] && lo<Low[shiftSBar+1])) && getTicketByComment(“HHHL”+IntegerToString(Time[1]))==0) {

computeForShort();

SE1_TimeSBar = Time[1];

if(High[1]-Low[2]>ATRH*ATRHKoeffForSpecialExpirationEntryType1) expir = TimeCurrent()+ExpirationSpecialEntryType1*60*60;

else expir = TimeCurrent()+ExpirationEntryType1*60*60;

int t = getTicketByComment(“HHHL”);

if(t>0) {

if(OrderSelect(t,SELECT_BY_TICKET) && OrderType()==OP_SELLSTOP) {

bool d = OrderDelete(t,clrSilver);

if(!d) Print(“Error delete order “+IntegerToString(_LastError));

return;

}

}

Print(“Place Short Entry Type1”);

sellStop(getLots(),NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits),”HHHL”+IntegerToString(SE1_TimeSBar)+”S”+DoubleToString(spread,0),expir); return;

}

}

//*****************************************************************************************

//Long Entry Type4

if(ReversalIBWithin && ((ReversalIB && LE3_TimeSBar>0)|| (ContinuationIB && LE5_TimeSBar>0 && Low[7]>Low[2] && Low[8]>Low[2] && Low[9]>Low[2] && Low[10]>Low[2] && Low[11]>Low[2] && Low[12]>Low[2] && Low[13]>Low[2] && Low[14]>Low[2])) && isIB() && Low[3]>Low[2] && Low[4]>Low[2] && Low[5]>Low[2] && Low[6]>Low[2]) {

if(LE3_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,LE3_TimeSBar,false) – 1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

if(shiftSBar>=0 && hi<=High[shiftSBar+1] && lo>=Low[shiftSBar]) {

if(getTicketByComment(“WLIB”+IntegerToString(Time[1]))==0) {

computeForLong();

expir = TimeCurrent()+ExpirationEntryType4*60*60;

Print(“Place Long Entry Type4”);

buyStop(getLots(), NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits), “WLIB”+IntegerToString(Time[1]), expir); return;

}

}

}

if(LE5_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,LE5_TimeSBar,false) – 1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

if(shiftSBar>=0 && hi<=High[shiftSBar+1] && lo>=Low[shiftSBar]) {

if(getTicketByComment(“WLIB”+IntegerToString(Time[1]))==0) {

computeForLong();

expir = TimeCurrent()+ExpirationEntryType4*60*60;

Print(“Place Long Entry Type4”);

buyStop(getLots(), NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits), “WLIB”+IntegerToString(Time[1]), expir); return;

}

}

}

}

//Short Entry Type4

if(ReversalIBWithin && ((ReversalIB && SE3_TimeSBar>0) || (ContinuationIB && SE5_TimeSBar && High[7]<High[2] && High[8]<High[2] && High[9]<High[2] && High[10]<High[2] && High[11]<High[2] && High[12]<High[2] && High[13]<High[2] && High[14]<High[2])) && isIB() && High[3]<High[2] && High[4]<High[2] && High[5]<High[2] && High[6]<High[2]) {

if(SE3_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,SE3_TimeSBar,false) – 1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

if(shiftSBar>=0 && hi<=High[shiftSBar] && lo>=Low[shiftSBar+1]) {

if(getTicketByComment(“WSIB”+IntegerToString(Time[1]))==0) {

computeForShort();

expir = TimeCurrent()+ExpirationEntryType4*60*60;

Print(“Place Short Entry Type4”);

sellStop(getLots(), NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits), “WSIB”+IntegerToString(Time[1]), expir); return;

}

}

}

if(SE5_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,SE5_TimeSBar,false) – 1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

if(shiftSBar>=0 && hi<=High[shiftSBar] && lo>=Low[shiftSBar+1]) {

if(getTicketByComment(“WSIB”+IntegerToString(Time[1]))==0) {

computeForShort();

expir = TimeCurrent()+ExpirationEntryType4*60*60;

Print(“Place Short Entry Type4”);

sellStop(getLots(), NormalizeDouble(entry,_Digits), NormalizeDouble(SL,_Digits), NormalizeDouble(TP,_Digits), “WSIB”+IntegerToString(Time[1]), expir); return;

}

}

}

}

//Long Entry Type3

if(ReversalIB && isIB() && Low[3]>Low[2] && Low[4]>Low[2] && Low[5]>Low[2] && Low[6]>Low[2]) {

if(LE3_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,LE3_TimeSBar,false)-1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

}

if((LE3_TimeSBar==0 || (shiftSBar>=0 && hi>High[shiftSBar+1] && lo<Low[shiftSBar])) && getTicketByComment(“LIB”+IntegerToString(Time[1]))==0) {

computeForLong();

LE3_TimeSBar = Time[1];

expir = TimeCurrent()+ExpirationEntryType3*60*60;

Print(“Place Long Entry Type3”);

buyStop(getLots(),NormalizeDouble(entry,_Digits),NormalizeDouble(SL,_Digits),NormalizeDouble(TP,_Digits),”LIB”+IntegerToString(LE3_TimeSBar)+”S”+DoubleToString(spread,0),expir); return;

}

}

//Short Entry Type3

if(ReversalIB && isIB() && High[3]<High[2] && High[4]<High[2] && High[5]<High[2] && High[6]<High[2]) {

if(SE3_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,SE3_TimeSBar,false)-1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

}

if((SE3_TimeSBar==0 || (shiftSBar>=0 && hi>High[shiftSBar] && lo<Low[shiftSBar+1])) && getTicketByComment(“SIB”+IntegerToString(Time[1]))==0) {

computeForShort();

SE3_TimeSBar = Time[1];

expir = TimeCurrent()+ExpirationEntryType3*60*60;

Print(“Place Short Entry Type3”);

sellStop(getLots(),NormalizeDouble(entry,_Digits),NormalizeDouble(SL,_Digits),NormalizeDouble(TP,_Digits),”SIB”+IntegerToString(SE3_TimeSBar)+”S”+DoubleToString(spread,0),expir); return;

}

}

//Open Long Entry Type5

if(ContinuationIB && isIB() && Low[3]>Low[2] && Low[4]>Low[2] && Low[5]>Low[2] && Low[6]>Low[2] && Low[7]>Low[2] && Low[8]>Low[2] &&

Low[9]>Low[2] && Low[10]>Low[2] && Low[11]>Low[2] && Low[12]>Low[2] && Low[13]>Low[2] && Low[14]>Low[2]) {

if(LE5_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,LE5_TimeSBar,false)-1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

}

if((LE5_TimeSBar==0 || (shiftSBar>=0 && hi>High[shiftSBar+1] && lo<Low[shiftSBar])) && getTicketByComment(“LCIB”+IntegerToString(Time[1]))==0) {

computeForLong();

LE5_TimeSBar = Time[1];

expir = TimeCurrent()+ExpirationEntryType5*60*60;

Print(“Place Long Entry Type5”);

buyStop(getLots(),NormalizeDouble(entry,_Digits),NormalizeDouble(SL,_Digits),NormalizeDouble(TP,_Digits),”LCIB”+IntegerToString(LE5_TimeSBar)+”S”+DoubleToString(spread,0),expir); return;

}

}

//Open Short Entry Type5

if(ContinuationIB && isIB() && High[3]<High[2] && High[4]<High[2] && High[5]<High[2] && High[6]<High[2] && High[7]<High[2] && High[8]<High[2] &&

High[9]<High[2] && High[10]<High[2] && High[11]<High[2] && High[12]<High[2] && High[13]<High[2] && High[14]<High[2]) {

if(SE5_TimeSBar>0) {

shiftSBar = iBarShift(_Symbol,PERIOD_CURRENT,SE5_TimeSBar,false)-1;

hi = High[iHighest(_Symbol,PERIOD_CURRENT,MODE_HIGH,shiftSBar,0)];

lo = Low[iLowest(_Symbol,PERIOD_CURRENT,MODE_LOW,shiftSBar,0)];

}

if((SE5_TimeSBar==0 || (shiftSBar>=0 && hi>High[shiftSBar] && lo<Low[shiftSBar+1])) && getTicketByComment(“SCIB”+IntegerToString(Time[1]))==0) {

computeForShort();

SE5_TimeSBar = Time[1];

expir = TimeCurrent()+ExpirationEntryType5*60*60;

Print(“Place Short Entry Type5”);

sellStop(getLots(),NormalizeDouble(entry,_Digits),NormalizeDouble(SL,_Digits),NormalizeDouble(TP,_Digits),”SCIB”+IntegerToString(SE5_TimeSBar)+”S”+DoubleToString(spread,0),expir); return;

}

}

}

//+——————————————————————+

// SL – stop loss level

// TP – target profit level

// Break – price level the pair needs to reach before you can move your SL to breakeven

// P1 – this is simply a 1-pip filter for our entries

// RSL – reduced stop loss; basically just reduces risk by half

// RSLT – price level when you can move your SL to RSL

void computeForLong() {

ATRH = iATR(_Symbol,PERIOD_H1,PeriodATRH,0);

spread = NormalizeDouble((Ask – Bid)/_Point,0);

entry = High[2] + P1Filter*_Point;

TP = entry – spread*_Point – P1Filter*_Point + ATRH*ATRHKoeffTP;

SL = entry – spread*_Point – P1Filter*_Point – ATRH*ATRHKoeffSL;

Break = TP – ATRH*ATRHKoeffBreak;

RSL = entry – spread*_Point – P1Filter*_Point – (ATRH*ATRHKoeffSL)*RSLKoeff;

RSLT = entry – spread*_Point – P1Filter*_Point + ATRH;

}

void computeForLongDt(int bshift, double lateSpread) {

int h1bshift = iBarShift(_Symbol,PERIOD_H1,Time[bshift],false);

ATRH = iATR(_Symbol,PERIOD_H1,PeriodATRH,h1bshift);

entry = High[bshift+1] + P1Filter*_Point;

TP = entry – lateSpread*_Point – P1Filter*_Point + ATRH*ATRHKoeffTP;

SL = entry – lateSpread*_Point – P1Filter*_Point – ATRH*ATRHKoeffSL;

Break = TP – ATRH*ATRHKoeffBreak;

RSL = entry – lateSpread*_Point – P1Filter*_Point – (ATRH*ATRHKoeffSL)*RSLKoeff;

RSLT = entry – lateSpread*_Point – P1Filter*_Point + ATRH;

}

void computeForShort() {

ATRH = iATR(_Symbol,PERIOD_H1,PeriodATRH,0);

spread = NormalizeDouble((Ask – Bid)/_Point,0);

entry = Low[2] – P1Filter*_Point;

TP = entry + spread*_Point + P1Filter*_Point – ATRH*ATRHKoeffTP;

SL = entry + spread*_Point + P1Filter*_Point + ATRH*ATRHKoeffSL;

Break = TP + ATRH*ATRHKoeffBreak;

RSL = entry + spread*_Point + P1Filter*_Point + (ATRH*ATRHKoeffSL)*RSLKoeff;

RSLT = entry + spread*_Point + P1Filter*_Point – ATRH;

}

void computeForShortDt(int bshift, double lateSpread) {

int h1bshift = iBarShift(_Symbol,PERIOD_H1,Time[bshift],true);

ATRH = iATR(_Symbol,PERIOD_H1,PeriodATRH,h1bshift);

entry = Low[2] – P1Filter*_Point;

TP = entry + lateSpread*_Point + P1Filter*_Point – ATRH*ATRHKoeffTP;

SL = entry + lateSpread*_Point + P1Filter*_Point + ATRH*ATRHKoeffSL;

Break = TP + ATRH*ATRHKoeffBreak;

RSL = entry + lateSpread*_Point + P1Filter*_Point + (ATRH*ATRHKoeffSL)*RSLKoeff;

RSLT = entry + lateSpread*_Point + P1Filter*_Point – ATRH;

}

//———————————————————————-

bool isHHHL() {

if(High[1]>High[2] && Low[1]>Low[2]) return true; // [1] is the signal bar ([1]SBar,[2]Bar1,[3]Bar2,[4]Bar3,[5]Bar4)

else return false;

}

bool isLHLL() {

if(High[1]<High[2] && Low[1]<Low[2]) return true;

else return false;

}

bool isIB() {

if(High[1]<High[2] && Low[1]>Low[2]) return true;

else return false;

}

//———————————————————————

void modifyBuy(int ticket, double price, double sl, double tp, datetime expirat) {

if((Bid-sl)/_Point<freezy) sl=Bid-freezy*_Point;

if((Bid-sl)/_Point<stoplevel) sl = Bid-stoplevel*_Point;

bool m = OrderModify(ticket,price,NormalizeDouble(sl,_Digits),tp,expirat,clrYellow);

if(!m) Print(“Error modify buy order “+IntegerToString(_LastError));

}

void modifySell(int ticket, double price, double sl, double tp, datetime expirat) {

if((sl-Ask)/_Point<freezy) sl=Ask+freezy*_Point;

if((sl-Ask)/_Point<stoplevel) sl = Ask+stoplevel*_Point;

bool m = OrderModify(ticket,price,NormalizeDouble(sl,_Digits),tp,expirat,clrYellow);

if(!m) Print(“Error modify sell order “+IntegerToString(_LastError));

}

//—————————————————————————————–

void buyStop(double volume, double price, double sl, double tp, string comment, datetime expiration) {

RefreshRates();

if((price-Ask)/_Point<stoplevel) price = Ask + stoplevel*_Point;

if(sl>0.0 && (price-sl)/_Point<stoplevel) sl = price-stoplevel*_Point;

if(tp>0.0 && (tp-price)/_Point<stoplevel) tp = price+stoplevel*_Point;

int ticket = OrderSend(_Symbol,OP_BUYSTOP,volume,NormalizeDouble(price,_Digits),Slippage,NormalizeDouble(sl,_Digits),NormalizeDouble(tp,_Digits),comment,Magic,expiration,clrLime);

if(ticket==-1) Print(“Error open buystop “+IntegerToString(_LastError)+” [“+DoubleToStr(Ask,_Digits)+”,”+DoubleToStr(price,_Digits)+”,”+DoubleToStr(sl,_Digits)+”,”+DoubleToStr(tp,_Digits)+”]”);

}

void sellStop(double volume, double price, double sl, double tp, string comment, datetime expiration) {

RefreshRates();

if((Bid-price)/_Point<stoplevel) {/*Print(“***YYY1”);*/ price = Bid – stoplevel*_Point; }

if(sl>0.0 && (sl-price)/_Point<stoplevel) {/*Print(“***YYY2”);*/ sl = price+stoplevel*_Point; }

if(tp>0.0 && (price-tp)/_Point<stoplevel) {/*Print(“***YYY3”);*/ tp = price-stoplevel*_Point; }

int ticket=OrderSend(_Symbol,OP_SELLSTOP,volume,NormalizeDouble(price,_Digits),Slippage,NormalizeDouble(sl,_Digits),NormalizeDouble(tp,_Digits),comment,Magic,expiration,clrRed);

if(ticket==-1) Print(“Error open sellstop “+IntegerToString(_LastError)+” [“+DoubleToStr(Bid,_Digits)+”,”+DoubleToStr(price,_Digits)+”,”+DoubleToStr(sl,_Digits)+”,”+DoubleToStr(tp,_Digits)+”]”);

//else Print(“SUCC “+IntegerToString(_LastError)+” [“+DoubleToStr(Bid,_Digits)+”,”+DoubleToStr(price,_Digits)+”,”+DoubleToStr(sl,_Digits)+”,”+DoubleToStr(tp,_Digits)+”]”);

}

//————————————————————————–

int getTicketByComment(string comm) {

int total = OrdersTotal();

for(int j=0; j<total; j++) {

if(OrderSelect(j,SELECT_BY_POS)) {

if(StringFind(OrderComment(),comm)>=0) return OrderTicket();

}

}

return 0;

}

//————————————————————————–

double getLots() {

double lot = 0.0;

double step = MarketInfo(Symbol(),MODE_LOTSTEP);

if(FixedLot>0.0) lot = FixedLot;

else {

double free = AccountFreeMargin();

double lotsize = MarketInfo(Symbol(),MODE_LOTSIZE);

double onelot = MarketInfo(Symbol(),MODE_MARGINREQUIRED);

lot = MathFloor(free*PercentMargin/100/onelot/step)*step;

}

double max = MarketInfo(Symbol(), MODE_MAXLOT);

double min = MarketInfo(Symbol(), MODE_MINLOT);

if(step>=1.0) lot = NormalizeDouble(lot, 0);

else if(step>=0.1) lot = NormalizeDouble(lot, 1);

else if(step<0.1) lot = NormalizeDouble(lot, 2);

if(lot>max) lot = max;

if(lot<min) lot = min;

return lot;

}

/////////////////////////////////////////////////////////////////////////////////

相关资源

暂无评论...