//+——————————————————————+

//| EA MFI_R2-v21.mq4 |

//| Copyright 2019, MetaQuotes Software Corp. |

//| https://www.mql5.com |

//+——————————————————————+

#property version ” ”

#property strict

#include <stdlib.mqh>

// This makes code easier to read

#define AUDCAD 1

#define AUDJPY 2

#define AUDNZD 3

#define AUDUSD 4

#define CHFJPY 5

#define EURAUD 6

#define EURCAD 7

#define EURCHF 8

#define EURGBP 9

#define EURJPY 10

#define EURUSD 11

#define GBPCHF 12

#define GBPJPY 13

#define GBPUSD 14

#define NZDJPY 15

#define NZDUSD 16

#define USDCAD 17

#define USDCHF 18

#define USDJPY 19

#define UNEXPECTED 999

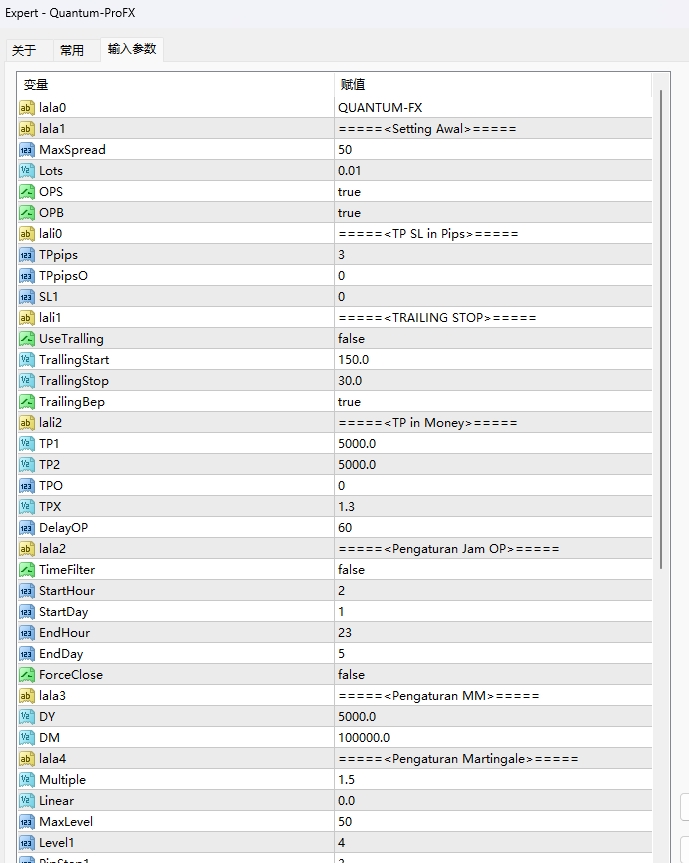

extern string Expert_Name = “—- EA MFI_R2_v21 —-“;

//+—————————————————+

//|Money Management |

//+—————————————————+

extern double LotSize=0.1;

extern double RiskPercent=2.0;

extern bool UseMoneyMgmt=false;

extern bool BrokerPermitsFractionalLots = true;

//+—————————————————+

//|Indicator Variables |

//| Change these to try your own system |

//| or add more if you like |

//+—————————————————+

extern string mi=”–Moving Average settings–“;

extern int MaTrend_Period = 200;

extern string ri=”–MFI settings–“;

extern int MFI_Period = 5; // input value to be optimized

extern bool UseDefaultMFI_Period = true;

extern int BuyWhenMFIBelow = 65;

extern int SellWhenMFIAbove = 35;

extern double MFI_Overbought_Value = 75.0;

extern double MFI_Oversold_Value = 25.0;

// Added to test confirmation of trend

extern int useMFI4BarsBack = 0;

extern int BuyWhenAbove = 55;

extern int SellWhenBelow = 45;

// Added to test new exit strategy

extern int useNewExitStrategy = 0;

extern int MFI_High_OverBought_Exit = 98;

extern int MFI_Low_OverSold_Exit = 2;

// Added Blutos newest exit using Price close vs SMA 200

extern int use200SMA_Exit = 1;

extern int useMFI14_Exit = 1;

extern int MFI_Exit_Period = 14;

extern int useCCI50_Exit = 0;

extern int CCI_ExitLevel = 0;

extern string st1=”–Signal_TimeFrame–“;

extern int Signal_TimeFrame = 0;

extern string hd = ” –Limit 1 trade per day –“;

extern int useDelay = 1;

// Added this for possible filter for flat markets

extern string ai=”–Moving Average Angle filter settings–“;

extern string a2=” Set switch to 1 to use filter”;

extern int useMaAngleFilter = 0;

extern int TrendTimeFrame = 0;

extern double Threshold=20;

extern int PrevShift=3;

extern int CurShift=1;

//+—————————————————+

//|Profit controls |

//+—————————————————+

extern string st6 = “–Profit Controls–“;

extern double StopLoss=0;

extern double TakeProfit=700;

extern int Slippage=3;

extern string tsp0 = “–Trailing Stop Types–“;

extern string tsp1 = ” 1 = Trail immediately”;

extern string tsp2 = ” 2 = Wait to trail”;

extern string tsp3 = ” 3 = Uses 3 levels before trail”;

extern string tsp4 = ” 4 = Breakeven + Lockin”;

extern string tsp5 = ” 5 = Step trail”;

extern string tsp6 = ” 6 = EMA trail”;

extern string tsp7 = ” 7 = pSAR trail”;

extern string tsp8 = ” 8 = Blutos pSar trail”;

extern bool UseTrailingStop = true;

extern int TrailingStopType = 8;

extern string ts2 = “Settings for Type 2”;

extern double TrailingStop = 15; // Change to whatever number of pips you wish to trail your position with.

extern string ts3 = “Settings for Type 3”;

extern double FirstMove = 20; // Type 3 first level pip gain

extern double FirstStopLoss = 50; // Move Stop to Breakeven

extern double SecondMove = 30; // Type 3 second level pip gain

extern double SecondStopLoss = 30; // Move stop to lock is profit

extern double ThirdMove = 40; // type 3 third level pip gain

extern double TrailingStop3 = 20; // Move stop and trail from there

extern string ts4 = “Settings for Type 4”;

extern double BreakEven = 30;

extern int LockInPips = 1; // Profit Lock in pips

extern string ts5 = “Settings for Type 5”;

extern int eTrailingStop = 10;

extern int eTrailingStep = 2;

extern string ts6 = “Settings for Type 6”;

extern int EMATimeFrame = 30;

extern int Price = 0;

extern int EMAPeriod = 13;

extern int EMAShift = 2;

extern int InitialStop = 0;

extern string ts7 = “Settings for Type 7″;

extern string pi=”–pSAR settings–“;

extern double StepParabolic = 0.02;

extern double MaxParabolic = 0.2;

extern int Interval = 5;

extern string ts8 = “Settings for Type 8″;

extern string pi2=”–pSAR settings–“;

extern double SarStep = 0.02;

extern double SarMax = 0.20;

bool dummyResult;

//+—————————————————+

//|General controls |

//+—————————————————+

int MagicNumber=0;

string setup;

int SignalCandle = 1;

int TradesInThisSymbol = 0;

double MM_OrderLotSize=0;

datetime StopTime; // Time to wait after a trade is stopped out

bool StoppedOut=false;

//+—————————————————+

//| Indicator values for signals and filters |

//| Add or Change to test your system |

//+—————————————————+

int myMFI_Period = 2; // Used by MFI indicator call

double MFI_Day_0 = 0, MFI_Day_1=0, MFI_Day_2=0, MFI_Day_3=0, SMA_Day3=0;

int init()

{

/*

if (Symbol()==”AUDCADm” || Symbol()==”AUDCAD”) {MagicNumber=200001;}

if (Symbol()==”AUDJPYm” || Symbol()==”AUDJPY”) {MagicNumber=200002;}

if (Symbol()==”AUDNZDm” || Symbol()==”AUDNZD”) {MagicNumber=200003;}

if (Symbol()==”AUDUSDm” || Symbol()==”AUDUSD”) {MagicNumber=200004;}

if (Symbol()==”CHFJPYm” || Symbol()==”CHFJPY”) {MagicNumber=200005;}

if (Symbol()==”EURAUDm” || Symbol()==”EURAUD”) {MagicNumber=200006;}

if (Symbol()==”EURCADm” || Symbol()==”EURCAD”) {MagicNumber=200007;}

if (Symbol()==”EURCHFm” || Symbol()==”EURCHF”) {MagicNumber=200008;}

if (Symbol()==”EURGBPm” || Symbol()==”EURGBP”) {MagicNumber=200009;}

if (Symbol()==”EURJPYm” || Symbol()==”EURJPY”) {MagicNumber=200010;}

if (Symbol()==”EURUSDm” || Symbol()==”EURUSD”) {MagicNumber=200011;}

if (Symbol()==”GBPCHFm” || Symbol()==”GBPCHF”) {MagicNumber=200012;}

if (Symbol()==”GBPJPYm” || Symbol()==”GBPJPY”) {MagicNumber=200013;}

if (Symbol()==”GBPUSDm” || Symbol()==”GBPUSD”) {MagicNumber=200014;}

if (Symbol()==”NZDJPYm” || Symbol()==”NZDJPY”) {MagicNumber=200015;}

if (Symbol()==”NZDUSDm” || Symbol()==”NZDUSD”) {MagicNumber=200016;}

if (Symbol()==”USDCHFm” || Symbol()==”USDCHF”) {MagicNumber=200017;}

if (Symbol()==”USDJPYm” || Symbol()==”USDJPY”) {MagicNumber=200018;}

if (Symbol()==”USDCADm” || Symbol()==”USDCAD”) {MagicNumber=200019;}

if (MagicNumber==0) {MagicNumber = 200999;}

*/

//#################################################################################################################

// MagicNumber = func_Symbol2Val(Symbol()) + 200000;

MagicNumber = 200000 + func_Symbol2Val(Symbol())*100 + func_TimeFrame_Const2Val(Period());

setup=Expert_Name + Symbol() + “_” + func_TimeFrame_Val2String(func_TimeFrame_Const2Val(Period()));

if (UseDefaultMFI_Period) myMFI_Period = MFI_Period; else myMFI_Period = AssignMFI_Period(Symbol());

return(0);

}

int deinit()

{

return(0);

}

int AssignMFI_Period(string symbol)

{

int MFI = 0;

int which = func_Symbol2Val(symbol);

switch (which)

{

case AUDCAD : MFI = 5;

break;

case AUDJPY : MFI = 7;

break;

case AUDNZD : MFI = 6;

break;

case AUDUSD : MFI = 4;

break;

case CHFJPY : MFI = 4;

break;

case EURAUD : MFI = 2;

break;

case EURCAD : MFI = 3;

break;

case EURCHF : MFI = 3;

break;

case EURGBP : MFI = 2;

break;

case EURJPY : MFI = 4; // Optimized value

break;

case EURUSD : MFI = 4;

break;

case GBPCHF : MFI = 6;

break;

case GBPJPY : MFI = 4;

break;

case GBPUSD : MFI = 3;

break;

case NZDJPY : MFI = 6;

break;

case NZDUSD : MFI = 7;

break;

case USDCAD : MFI = 2;

break;

case USDCHF : MFI = 4;

break;

case USDJPY : MFI = 4;

break;

case UNEXPECTED : MFI = 4;

}

if (MFI == 0) MFI = 4;

return (MFI);

}

//+——————————————————————+

//| LastTradeStoppedOut |

//| Check History to see if last trade stopped out |

//| Return Time for next trade |

//+——————————————————————+

//+——————————————————————+

//| LastTradeClosedToday |

//| Check History to see if last trade closed today |

//+——————————————————————+

bool LastTradeClosedToday()

{

int cnt, total;

bool Closed;

total = HistoryTotal();

for (cnt = total – 1; cnt >= 0; cnt–)

{

dummyResult=OrderSelect (cnt, SELECT_BY_POS, MODE_HISTORY);

if(OrderSymbol()!=Symbol()) continue;

if (OrderMagicNumber() != MagicNumber) continue;

Closed = false;

if (OrderType() == OP_BUY)

{

if (TimeDay(OrderCloseTime()) == TimeDay(TimeCurrent()))

{

Closed = true;

}

cnt = 0;

}

if (OrderType() == OP_SELL)

{

if (TimeDay(OrderCloseTime()) == TimeDay(TimeCurrent()))

{

Closed = true;

}

cnt = 0;

}

}

return (Closed);

}

//===================================================================

// EMA_Angle.mq4

// jpkfox

//

// You can use this indicator to measure when the EMA angle is

// “near zero”. AngleTreshold determines when the angle for the

// EMA is “about zero”: This is when the value is between

// [-AngleTreshold, AngleTreshold] (or when the histogram is red).

// EMAPeriod: EMA period

// AngleTreshold: The angle value is “about zero” when it is

// between the values [-AngleTreshold, AngleTreshold].

// StartEMAShift: The starting point to calculate the

// angle. This is a shift value to the left from the

// observation point. Should be StartEMAShift > EndEMAShift.

// StartEMAShift: The ending point to calculate the

// angle. This is a shift value to the left from the

// observation point. Should be StartEMAShift > EndEMAShift.

//

// Return 1 for up OK

// Return -1 for down OK

// Return 0 for too flat

//===================================================================

double MA_Angle( int iPrevShift, int iCurShift, double fPrevMA, double fCurMA)

{

double fAngle, mFactor;

string Sym;

int ShiftDif;

mFactor = 100000.0;

Sym = StringSubstr(Symbol(),3,3);

if (Sym == “JPY”) mFactor = 1000.0;

ShiftDif = iPrevShift-iCurShift;

mFactor /= ShiftDif;

fAngle = mFactor * (fCurMA – fPrevMA)/2.0;

return(fAngle);

}

bool CheckTrend(int cmd)

{

double maAngle;

double MACurrent=iMA(Symbol(),TrendTimeFrame,MaTrend_Period, 0, MODE_SMA, PRICE_CLOSE,CurShift);

double MAPrevious=iMA(Symbol(),TrendTimeFrame,MaTrend_Period, 0, MODE_SMA, PRICE_CLOSE,PrevShift);

maAngle = MA_Angle(PrevShift, CurShift, MAPrevious, MACurrent);

switch (cmd)

{

case OP_BUY : if (maAngle > Threshold) return(true);

break;

case OP_SELL : if (maAngle < -Threshold) return(true);

}

return(false);

}

bool CheckMFI14(int cmd)

{

double MFIcur, MFIprev;

MFIcur = iMFI(Symbol(),Signal_TimeFrame, MFI_Exit_Period, 1);

MFIprev = iMFI(Symbol(),Signal_TimeFrame, MFI_Exit_Period, 2);

switch (cmd)

{

case OP_BUY : if (MFIcur < 50 && MFIprev > 50) return(true);

break;

case OP_SELL : if (MFIcur > 50 && MFIprev < 50) return(true);

}

return(false);

}

bool CheckCCI50(int cmd)

{

double CCIcur, CCIprev;

CCIcur = iCCI(Symbol(), Signal_TimeFrame, 50, PRICE_CLOSE, 1);

CCIprev = iCCI(Symbol(), Signal_TimeFrame, 50, PRICE_CLOSE, 2);

switch (cmd)

{

case OP_BUY : if (CCIcur < 0 && CCIprev > 0) return(true);

break;

case OP_SELL : if (CCIcur > 0 && CCIprev < 0) return(true);

}

return(false);

}

//+——————————————————————+

//| CheckExitCondition |

//| Uses OP_BUY as cmd to check exit sell |

//| Uses OP_SELL as cmd to check exit buy |

//| New exit strategy checks current MFI value for high or low |

//| threshold and for current still less than overbought value |

//| or greater than oversold value. |

//+——————————————————————+

bool CheckExitCondition(int cmd)

{

double MFI, MFI_Cur;

MFI = iMFI(Symbol(), Signal_TimeFrame, myMFI_Period, 1);

MFI_Cur = iMFI(Symbol(), Signal_TimeFrame, myMFI_Period, 0);

switch (cmd)

{

case OP_BUY : if (useMFI14_Exit == 1) return (CheckMFI14(cmd));

if (useCCI50_Exit == 1) return(CheckCCI50(cmd));

// Original Exit Strategies

if ( MFI > MFI_Overbought_Value)

{

if (useNewExitStrategy == 1)

{

if (MFI_Cur < MFI_Overbought_Value || MFI_Cur >= MFI_High_OverBought_Exit ) return(true); else return(false);

}

else

return(true);

}

else if (use200SMA_Exit == 1)

{

if (CheckMA(OP_SELL)) return(true);

}

break;

case OP_SELL : if (useMFI14_Exit == 1) return (CheckMFI14(cmd));

if (useCCI50_Exit == 1) return(CheckCCI50(cmd));

// Original Exit Strategies

if (MFI < MFI_Oversold_Value)

{

if (useNewExitStrategy == 1)

{

if (MFI_Cur > MFI_Oversold_Value || MFI_Cur <= MFI_Low_OverSold_Exit ) return(true); else return(false);

}

else

return(true);

}

else if (use200SMA_Exit == 1)

{

if (CheckMA(OP_BUY)) return(true);

}

}

return (false);

}

bool CheckMA(int cmd)

{

SMA_Day3 = iMA(Symbol(),Signal_TimeFrame,MaTrend_Period, 0, MODE_SMA, PRICE_CLOSE, 1);

switch (cmd)

{

case OP_BUY : if (iClose(Symbol(),Signal_TimeFrame,1) > SMA_Day3) return(true);

break;

case OP_SELL : if (iClose(Symbol(),Signal_TimeFrame,1) < SMA_Day3) return (true);

}

return(false);

}

// Optional check of 4th bar back above 55 for buy

// or below 45 for sell to confirm trend

bool CheckMFI(int cmd)

{

MFI_Day_0 = iMFI(Symbol(), Signal_TimeFrame, myMFI_Period, 4);

MFI_Day_1 = iMFI(Symbol(), Signal_TimeFrame, myMFI_Period, 3);

MFI_Day_2 = iMFI(Symbol(), Signal_TimeFrame, myMFI_Period, 2);

MFI_Day_3 = iMFI(Symbol(), Signal_TimeFrame, myMFI_Period, 1);

switch (cmd)

{

case OP_BUY : if (MFI_Day_1 < BuyWhenMFIBelow && MFI_Day_2 < MFI_Day_1 && MFI_Day_3 < MFI_Day_2)

{

if (useMFI4BarsBack == 1)

{

if (MFI_Day_0 > BuyWhenAbove) return(true); else return(false);

}

else

return(true);

}

break;

case OP_SELL : if (MFI_Day_1 > SellWhenMFIAbove && MFI_Day_2 > MFI_Day_1 && MFI_Day_3 > MFI_Day_2)

{

if (useMFI4BarsBack == 1)

{

if (MFI_Day_0 < SellWhenBelow) return(true); else return(false);

}

else

return(true);

}

}

return(false);

}

//+——————————————————————+

//| CheckEntryCondition |

//+——————————————————————+

bool CheckEntryCondition(int cmd)

{

bool rule1, rule2, rule3;

rule1 = true;

rule2 = true;

rule3 = true;

rule1 = CheckMA(cmd);

if (rule1)

{

rule2 = CheckMFI(cmd);

if(rule2)

{

if (useMaAngleFilter == 1) rule3 = CheckTrend(cmd);

if (rule3) return(true);

}

}

return (false);

}

int start()

{

//+——————————————————————+

//| Check for Open Position |

//+——————————————————————+

HandleOpenPositions();

// Check if any open positions were not closed

TradesInThisSymbol = CheckOpenPositions();

// Only allow 1 trade per Symbol

if(TradesInThisSymbol > 0) {

return(0);}

// Check if last trade stopped out

if (useDelay == 1)

{

if (LastTradeClosedToday()) return(0);

}

MM_OrderLotSize = GetLots();

if(CheckEntryCondition(OP_BUY))

{

OpenBuyOrder(MM_OrderLotSize, StopLoss,TakeProfit, Slippage, setup, MagicNumber, Green);

return(0);

}

if(CheckEntryCondition(OP_SELL))

{

OpenSellOrder(MM_OrderLotSize, StopLoss,TakeProfit, Slippage, setup, MagicNumber, Red);

}

return(0);

}

double GetLots()

{

// variables used for money management

double MM_MinLotSize=0;

double MM_MaxLotSize=0;

double MM_LotStep=0;

double MM_Decimals=0;

int MM_AcctLeverage=0;

int MM_CurrencyLotSize=0;

double OrderLotSize;

//—– Money Management & Lot Sizing Stuff.

MM_AcctLeverage = AccountLeverage();

MM_MinLotSize = MarketInfo(Symbol(),MODE_MINLOT);

MM_MaxLotSize = MarketInfo(Symbol(),MODE_MAXLOT);

MM_LotStep = MarketInfo(Symbol(),MODE_LOTSTEP);

MM_CurrencyLotSize = MarketInfo(Symbol(),MODE_LOTSIZE);

if(MM_LotStep == 0.01) {MM_Decimals = 2;}

if(MM_LotStep == 0.1) {MM_Decimals = 1;}

if (UseMoneyMgmt == true)

{

OrderLotSize = AccountEquity() * (RiskPercent * 0.01) / (MM_CurrencyLotSize / MM_AcctLeverage);

if(BrokerPermitsFractionalLots == true)

OrderLotSize = StrToDouble(DoubleToStr(OrderLotSize,MM_Decimals));

else

OrderLotSize = MathRound(MM_OrderLotSize);

}

else

{

OrderLotSize = LotSize;

}

if (OrderLotSize < MM_MinLotSize) {OrderLotSize = MM_MinLotSize;}

if (OrderLotSize > MM_MaxLotSize) {OrderLotSize = MM_MaxLotSize;}

return(OrderLotSize);

}

//+——————————————————————+

//| OpenBuyOrder |

//| If Stop Loss or TakeProfit are used the values are calculated |

//| for each trade |

//+——————————————————————+

int OpenBuyOrder(double mLots, double mStopLoss, double mTakeProfit, int mSlippage, string mComment, int mMagic, color mColor)

{

int err,ticket, digits;

double myPrice, myBid, myStopLoss = 0, myTakeProfit = 0;

myPrice = MarketInfo(Symbol(), MODE_ASK);

myBid = MarketInfo(Symbol(), MODE_BID);

myStopLoss = StopLong(myBid,mStopLoss);

myTakeProfit = TakeLong(myBid,mTakeProfit);

// Normalize all price / stoploss / takeprofit to the proper # of digits.

digits = MarketInfo(Symbol( ), MODE_DIGITS) ;

if (digits > 0)

{

myPrice = NormalizeDouble( myPrice, digits);

myStopLoss = NormalizeDouble( myStopLoss, digits);

myTakeProfit = NormalizeDouble( myTakeProfit, digits);

}

ticket=OrderSend(Symbol(),OP_BUY,mLots,myPrice,mSlippage,myStopLoss,myTakeProfit,mComment,mMagic,0,mColor);

if (ticket > 0)

{

if (OrderSelect( ticket,SELECT_BY_TICKET, MODE_TRADES) )

{

Print(“BUY order opened : “, OrderOpenPrice( ));

// ModifyOrder(ticket,OrderOpenPrice( ), OrderStopLoss(), myTakeProfit);

}

}

else

{

err = GetLastError();

if(err==0)

{

return(ticket);

}

else

{

if(err==4 || err==137 ||err==146 || err==136) //Busy errors

{

Sleep(5000);

}

else //normal error

{

Print(“Error opening BUY order [” + setup + “]: (” + err + “) ” + ErrorDescription(err));

}

}

}

return(ticket);

}

//+——————————————————————+

//| OpenSellOrder |

//| If Stop Loss or TakeProfit are used the values are calculated |

//| for each trade |

//+——————————————————————+

void OpenSellOrder(double mLots, double mStopLoss, double mTakeProfit, int mSlippage, string mComment, int mMagic, color mColor)

{

int err, ticket, digits;

double myPrice, myAsk, myStopLoss = 0, myTakeProfit = 0;

myPrice = MarketInfo(Symbol( ), MODE_BID);

myAsk = MarketInfo(Symbol( ), MODE_ASK);

myStopLoss = StopShort(myAsk,mStopLoss);

myTakeProfit = TakeShort(myAsk,mTakeProfit);

// Normalize all price / stoploss / takeprofit to the proper # of digits.

digits = MarketInfo(Symbol( ), MODE_DIGITS) ;

if (digits > 0)

{

myPrice = NormalizeDouble( myPrice, digits);

myStopLoss = NormalizeDouble( myStopLoss, digits);

myTakeProfit = NormalizeDouble( myTakeProfit, digits);

}

ticket=OrderSend(Symbol(),OP_SELL,mLots,myPrice,mSlippage,myStopLoss,myTakeProfit,mComment,mMagic,0,mColor);

if (ticket > 0)

{

if (OrderSelect( ticket,SELECT_BY_TICKET, MODE_TRADES) )

{

Print(“Sell order opened : “, OrderOpenPrice());

// ModifyOrder(ticket,OrderOpenPrice( ), OrderStopLoss(), myTakeProfit);

}

}

else

{

err = GetLastError();

if(err==0)

{

return;

}

else

{

if(err==4 || err==137 ||err==146 || err==136) //Busy errors

{

Sleep(5000);

}

else //normal error

{

Print(“Error opening Sell order [” + mComment + “]: (” + err + “) ” + ErrorDescription(err));

}

}

}

return;

}

double StopLong(double price,int stop)

{

if(stop==0)

return(0);

else

return(price-(stop*Point));

}

double StopShort(double price,int stop)

{

if(stop==0)

return(0);

else

return(price+(stop*Point));

}

double TakeLong(double price,int take)

{

if(take==0)

return(0);

else

return(price+(take*Point));

}

double TakeShort(double price,int take)

{

if(take==0)

return(0);

else

return(price-(take*Point));

}

//+——————————————————————+

//| Handle Open Positions |

//| Check if any open positions need to be closed or modified |

//+——————————————————————+

int HandleOpenPositions()

{

int cnt;

for(cnt=OrdersTotal()-1;cnt>=0;cnt–)

{

dummyResult=OrderSelect (cnt, SELECT_BY_POS, MODE_TRADES);

if ( OrderSymbol() != Symbol()) continue;

if ( OrderMagicNumber() != MagicNumber) continue;

if(OrderType() == OP_BUY)

{

if (CheckExitCondition(OP_BUY))

{

CloseOrder(OrderTicket(),OrderLots(),OP_BUY);

}

else

{

if (UseTrailingStop)

{

HandleTrailingStop(OP_BUY,OrderTicket(),OrderOpenPrice(),OrderStopLoss(),OrderTakeProfit());

}

}

}

if(OrderType() == OP_SELL)

{

if (CheckExitCondition(OP_SELL))

{

CloseOrder(OrderTicket(),OrderLots(),OP_SELL);

}

else

{

if (UseTrailingStop)

{

HandleTrailingStop(OP_SELL,OrderTicket(),OrderOpenPrice(),OrderStopLoss(),OrderTakeProfit());

}

}

}

}

return(0);

}

//+——————————————————————+

//| Check Open Position Controls |

//+——————————————————————+

int CheckOpenPositions()

{

int cnt, total;

int NumTrades;

NumTrades = 0;

total=OrdersTotal();

for(cnt=OrdersTotal()-1;cnt>=0;cnt–)

{

dummyResult=OrderSelect (cnt, SELECT_BY_POS, MODE_TRADES);

if ( OrderSymbol() != Symbol()) continue;

if ( OrderMagicNumber() != MagicNumber) continue;

if(OrderType() == OP_BUY ) NumTrades++;

if(OrderType() == OP_SELL ) NumTrades++;

}

return (NumTrades);

}

int CloseOrder(int ticket,double numLots,int cmd)

{

int CloseCnt, err, digits;

double myPrice;

if (cmd == OP_BUY) myPrice = MarketInfo(Symbol( ), MODE_BID);

if (cmd == OP_SELL) myPrice = MarketInfo(Symbol( ), MODE_ASK);

digits = MarketInfo(Symbol( ), MODE_DIGITS) ;

if (digits > 0) myPrice = NormalizeDouble( myPrice, digits);

// try to close 3 Times

CloseCnt = 0;

while (CloseCnt < 3)

{

if (!OrderClose(ticket,numLots,myPrice,Slippage,Violet))

{

err=GetLastError();

Print(CloseCnt,” Error closing order : (“, err , “) ” + ErrorDescription(err));

if (err > 0) CloseCnt++;

}

else

{

CloseCnt = 3;

}

}

return(0);

}

int ModifyOrder(int ord_ticket,double op, double price,double tp, color mColor)

{

int CloseCnt, err;

CloseCnt=0;

while (CloseCnt < 3)

{

if (OrderModify(ord_ticket,op,price,tp,0,mColor))

{

CloseCnt = 3;

}

else

{

err=GetLastError();

Print(CloseCnt,” Error modifying order : (“, err , “) ” + ErrorDescription(err));

if (err>0) CloseCnt++;

}

}

return(0);

}

double ValidStopLoss(int type, double price, double SL)

{

double minstop, pp;

double newSL;

pp = MarketInfo(Symbol(), MODE_POINT);

minstop = MarketInfo(Symbol(),MODE_STOPLEVEL);

newSL = SL;

if (type == OP_BUY)

{

if((price – SL) < minstop*pp) newSL = price – minstop*pp;

}

if (type == OP_SELL)

{

if((SL-price) < minstop*pp) newSL = price + minstop*pp;

}

return(newSL);

}

//+——————————————————————+

//| HandleTrailingStop |

//| Type 1 moves the stoploss without delay. |

//| Type 2 waits for price to move the amount of the trailStop |

//| before moving stop loss then moves like type 1 |

//| Type 3 uses up to 3 levels for trailing stop |

//| Level 1 Move stop to 1st level |

//| Level 2 Move stop to 2nd level |

//| Level 3 Trail like type 1 by fixed amount other than 1 |

//| Type 4 Move stop to breakeven + Lockin, no trail |

//| Type 5 uses steps for 1, every step pip move moves stop 1 pip |

//| Type 6 Uses EMA to set trailing stop |

//+——————————————————————+

int HandleTrailingStop(int type, int ticket, double op, double os, double tp)

{

switch (TrailingStopType)

{

case 1 : Immediate_TrailingStop (type, ticket, op, os, tp);

break;

case 2 : Delayed_TrailingStop (type, ticket, op, os, tp);

break;

case 3 : ThreeLevel_TrailingStop (type, ticket, op, os, tp);

break;

case 4 : BreakEven_TrailingStop (type, ticket, op, os, tp);

break;

case 5 : eTrailingStop (type, ticket, op, os, tp);

break;

case 6 : EMA_TrailingStop (type, ticket, op, os, tp);

break;

case 7 : pSAR_TrailingStop (type, ticket, op, os, tp);

break;

case 8 : BlutoParabolicSAR (type, ticket, op, os, tp);

break;

}

return(0);

}

//+——————————————————————+

//| BreakEvenExpert_v1.mq4 |

//| Copyright © 2006, Forex-TSD.com |

//| Written by IgorAD,[email protected] |

//| http://finance.groups.yahoo.com/group/TrendLaboratory |

//+——————————————————————+

void BreakEven_TrailingStop(int type, int ticket, double op, double os, double tp)

{

int digits;

double pBid, pAsk, pp, BuyStop, SellStop;

pp = MarketInfo(Symbol(), MODE_POINT);

digits = MarketInfo(Symbol(), MODE_DIGITS);

if (type==OP_BUY)

{

pBid = MarketInfo(Symbol(), MODE_BID);

if ( pBid-op > pp*BreakEven )

{

BuyStop = op + LockInPips * pp;

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY,pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

if (os < BuyStop) ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

return;

}

}

if (type==OP_SELL)

{

pAsk = MarketInfo(Symbol(), MODE_ASK);

if ( op – pAsk > pp*BreakEven )

{

SellStop = op – LockInPips * pp;

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

if (os > SellStop) ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

return;

}

}

}

//+——————————————————————+

//| e-Trailing.mq4 |

//| Êèì Èãîðü Â. aka KimIV |

//| http://www.kimiv.ru |

//| |

//| 12.09.2005 Àâòîìàòè÷åñêèé Trailing Stop âñåõ îòêðûòûõ ïîçèöèé |

//| Âåøàòü òîëüêî íà îäèí ãðàôèê |

//+——————————————————————+

void eTrailingStop(int type, int ticket, double op, double os, double tp)

{

int digits;

double pBid, pAsk, pp, BuyStop, SellStop;

pp = MarketInfo(Symbol(), MODE_POINT);

digits = MarketInfo(Symbol(), MODE_DIGITS) ;

if (type==OP_BUY)

{

pBid = MarketInfo(Symbol(), MODE_BID);

if ((pBid-op)>eTrailingStop*pp)

{

if (os<pBid-(eTrailingStop+eTrailingStep-1)*pp)

{

BuyStop = pBid-eTrailingStop*pp;

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY, pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

return;

}

}

}

if (type==OP_SELL)

{

pAsk = MarketInfo(Symbol(), MODE_ASK);

if (op – pAsk > eTrailingStop*pp)

{

if (os > pAsk + (eTrailingStop + eTrailingStep-1)*pp || os==0)

{

SellStop = pAsk + eTrailingStop * pp;

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

return;

}

}

}

}

//+——————————————————————+

//| EMATrailingStop_v1.mq4 |

//| Copyright © 2006, Forex-TSD.com |

//| Written by IgorAD,[email protected] |

//| http://finance.groups.yahoo.com/group/TrendLaboratory |

//+——————————————————————+

void EMA_TrailingStop(int type, int ticket, double op, double os, double tp)

{

int digits;

double pBid, pAsk, pp, BuyStop, SellStop, ema;

pp = MarketInfo(Symbol(), MODE_POINT);

digits = MarketInfo(Symbol(), MODE_DIGITS) ;

ema = iMA(Symbol(),EMATimeFrame,EMAPeriod,0,MODE_EMA,Price,EMAShift);

if (type==OP_BUY)

{

BuyStop = ema;

pBid = MarketInfo(Symbol(),MODE_BID);

if(os == 0 && InitialStop>0 ) BuyStop = pBid-InitialStop*pp;

if (digits > 0) BuyStop = NormalizeDouble(SellStop, digits);

BuyStop = ValidStopLoss(OP_BUY, pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

Print(“MA=”,ema,” BuyStop=”,BuyStop);

if ((op <= BuyStop && BuyStop > os) || os==0)

{

ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

return;

}

}

if (type==OP_SELL)

{

SellStop = ema;

pAsk = MarketInfo(Symbol(),MODE_ASK);

if (os==0 && InitialStop > 0) SellStop = pAsk+InitialStop*pp;

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

Print(“MA=”,ema,” SellStop=”,SellStop);

if( (op >= SellStop && os > SellStop) || os==0)

{

ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

return;

}

}

}

//+——————————————————————+

//| b-TrailingSAR.mqh |

//| Êèì Èãîðü Â. aka KimIV |

//| http://www.kimiv.ru |

//| |

//| 21.11.2005 Áèáëèîòåêà ôóíêöèé òðàëà ïî ïàðàáîëèêó. |

//| Äëÿ èñïîëüçîâàíèÿ äîáàâèòü ñòðîêó â ìîäóëå start |

//| if (UseTrailing) TrailingPositions(); |

//+——————————————————————+

void pSAR_TrailingStop(int type, int ticket, double op, double os, double tp)

{

int digits;

double pBid, pAsk, pp, BuyStop, SellStop, spr;

double sar1, sar2;

pp = MarketInfo(Symbol(), MODE_POINT);

digits = MarketInfo(Symbol(), MODE_DIGITS) ;

pBid = MarketInfo(Symbol(), MODE_BID);

pAsk = MarketInfo(Symbol(), MODE_ASK);

sar1=iSAR(NULL, 0, StepParabolic, MaxParabolic, 1);

sar2=iSAR(NULL, 0, StepParabolic, MaxParabolic, 2);

spr = pAsk – pBid;

if (digits > 0) spr = NormalizeDouble(spr, digits);

if (type==OP_BUY)

{

pBid = MarketInfo(Symbol(), MODE_BID);

if (sar2 < sar1)

{

BuyStop = sar1-Interval*pp;

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY, pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

if (os<BuyStop) ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

}

}

if (type==OP_SELL)

{

if (sar2 > sar1)

{

SellStop = sar1 + Interval * pp + spr;

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

if (os>SellStop || os==0) ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

}

}

}

// Manage Paraolic SAR

void BlutoParabolicSAR(int type, int ticket, double op, double os, double tp)

{

double pSar1 = 0, pSar2 = 0;

int digits;

double pBid, pAsk, pp;

pp = MarketInfo(Symbol(), MODE_POINT);

digits = MarketInfo(Symbol( ), MODE_DIGITS);

// Added pSar1 and pSar2 for faster backtesting

pSar1 = iSAR(NULL,Signal_TimeFrame,SarStep,SarMax,1);

pSar2 = iSAR(NULL,Signal_TimeFrame,SarStep,SarMax,2);

if (type == OP_BUY)

{

pBid = MarketInfo(Symbol(), MODE_BID);

if ( (pSar1> os) && (pBid > pSar1) && (op < pSar1) && (pSar1 > pSar2))

{

if (digits > 0)pSar1 = NormalizeDouble(pSar1, digits);

ModifyOrder(ticket,op,pSar1,tp,Blue);

Print(“Order # “,ticket,” updated at “,Hour(),”:”,Minute(),”:”,Seconds());

return;

}

}

if (type == OP_SELL)

{

pAsk = MarketInfo(Symbol(), MODE_ASK);

if ((pSar1 < os) && (pAsk < pSar1) && (op > pSar1) && (pSar1 < pSar2))

{

ModifyOrder(ticket,op,pSar1,tp,Blue);

Print(“Order # “,ticket,” updated at “,Hour(),”:”,Minute(),”:”,Seconds());

return;

}

}

}

//+——————————————————————+

//| ThreeLevel_TrailingStop.mq4 |

//| Copyright © 2006, Forex-TSD.com |

//| Written by MrPip,[email protected] |

//| |

//| Uses up to 3 levels for trailing stop |

//| Level 1 Move stop to 1st level |

//| Level 2 Move stop to 2nd level |

//| Level 3 Trail like type 1 by fixed amount other than 1 |

//+——————————————————————+

void ThreeLevel_TrailingStop(int type, int ticket, double op, double os, double tp)

{

int digits;

double pBid, pAsk, pp, BuyStop, SellStop;

pp = MarketInfo(Symbol(), MODE_POINT);

digits = MarketInfo(Symbol(), MODE_DIGITS) ;

if (type == OP_BUY)

{

pBid = MarketInfo(Symbol(), MODE_BID);

if (pBid – op > FirstMove * pp)

{

BuyStop = op + FirstMove*pp – FirstStopLoss * pp;

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY, pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

if (os < BuyStop) ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

}

if (pBid – op > SecondMove * pp)

{

BuyStop = op + SecondMove*pp – SecondStopLoss * pp;

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY, pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

if (os < BuyStop) ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

}

if (pBid – op > ThirdMove * pp)

{

BuyStop = pBid – ThirdMove*pp;

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY, pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble(BuyStop, digits);

if (os < BuyStop) ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

}

}

if (type == OP_SELL)

{

pAsk = MarketInfo(Symbol(), MODE_ASK);

if (op – pAsk > FirstMove * pp)

{

SellStop = op – FirstMove * pp + FirstStopLoss * pp;

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

if (os > SellStop) ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

}

if (op – pAsk > SecondMove * pp)

{

SellStop = op – SecondMove * pp + SecondStopLoss * pp;

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

if (os > SellStop) ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

}

if (op – pAsk > ThirdMove * pp)

{

SellStop = pAsk + ThirdMove * pp;

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble(SellStop, digits);

if (os > SellStop) ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

}

}

}

//+——————————————————————+

//| Immediate_TrailingStop.mq4 |

//| Copyright © 2006, Forex-TSD.com |

//| Written by MrPip,[email protected] |

//| |

//| Moves the stoploss without delay. |

//+——————————————————————+

void Immediate_TrailingStop(int type, int ticket, double op, double os, double tp)

{

int digits;

double pt, pBid, pAsk, pp, BuyStop, SellStop;

pp = MarketInfo(Symbol(), MODE_POINT);

digits = MarketInfo(Symbol( ), MODE_DIGITS);

if (type==OP_BUY)

{

pBid = MarketInfo(Symbol(), MODE_BID);

pt = StopLoss * pp;

if(pBid-os > pt)

{

BuyStop = pBid – pt;

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY,pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

if (os < BuyStop) ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

return;

}

}

if (type==OP_SELL)

{

pAsk = MarketInfo(Symbol(), MODE_ASK);

pt = StopLoss * pp;

if(os – pAsk > pt)

{

SellStop = pAsk + pt;

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

if (os > SellStop) ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

return;

}

}

}

//+——————————————————————+

//| Delayed_TrailingStop.mq4 |

//| Copyright © 2006, Forex-TSD.com |

//| Written by MrPip,[email protected] |

//| |

//| Waits for price to move the amount of the TrailingStop |

//| Moves the stoploss pip for pip after delay. |

//+——————————————————————+

void Delayed_TrailingStop(int type, int ticket, double op, double os, double tp)

{

int digits;

double pt, pBid, pAsk, pp, BuyStop, SellStop;

pp = MarketInfo(Symbol(), MODE_POINT);

pt = TrailingStop * pp;

digits = MarketInfo(Symbol(), MODE_DIGITS);

if (type==OP_BUY)

{

pBid = MarketInfo(Symbol(), MODE_BID);

BuyStop = pBid – pt;

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

BuyStop = ValidStopLoss(OP_BUY,pBid, BuyStop);

if (digits > 0) BuyStop = NormalizeDouble( BuyStop, digits);

if (pBid-op > pt && os < BuyStop) ModifyOrder(ticket,op,BuyStop,tp,LightGreen);

return;

}

if (type==OP_SELL)

{

pAsk = MarketInfo(Symbol(), MODE_ASK);

pt = TrailingStop * pp;

SellStop = pAsk + pt;

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

SellStop = ValidStopLoss(OP_SELL, pAsk, SellStop);

if (digits > 0) SellStop = NormalizeDouble( SellStop, digits);

if (op – pAsk > pt && os > SellStop) ModifyOrder(ticket,op,SellStop,tp,DarkOrange);

return;

}

}

int func_Symbol2Val(string symbol)

{

string mySymbol = StringSubstr(symbol,0,6);

if(mySymbol==”AUDCAD”) return(1);

if(mySymbol==”AUDJPY”) return(2);

if(mySymbol==”AUDNZD”) return(3);

if(mySymbol==”AUDUSD”) return(4);

if(mySymbol==”CHFJPY”) return(5);

if(mySymbol==”EURAUD”) return(6);

if(mySymbol==”EURCAD”) return(7);

if(mySymbol==”EURCHF”) return(8);

if(mySymbol==”EURGBP”) return(9);

if(mySymbol==”EURJPY”) return(10);

if(mySymbol==”EURUSD”) return(11);

if(mySymbol==”GBPCHF”) return(12);

if(mySymbol==”GBPJPY”) return(13);

if(mySymbol==”GBPUSD”) return(14);

if(mySymbol==”NZDJPY”) return(15);

if(mySymbol==”NZDUSD”) return(16);

if(mySymbol==”USDCAD”) return(17);

if(mySymbol==”USDCHF”) return(18);

if(mySymbol==”USDJPY”) return(19);

Comment(“unexpected Symbol”);

return(999);

}

//+——————————————————————+

//| Time frame interval appropriation function |

//+——————————————————————+

int func_TimeFrame_Const2Val(int Constant ) {

switch(Constant) {

case 1: // M1

return(1);

case 5: // M5

return(2);

case 15:

return(3);

case 30:

return(4);

case 60:

return(5);

case 240:

return(6);

case 1440:

return(7);

case 10080:

return(8);

case 43200:

return(9);

}

return(0);

}

//+——————————————————————+

//| Time frame string appropriation function |

//+——————————————————————+

string func_TimeFrame_Val2String(int Value ) {

switch(Value) {

case 1: // M1

return(“PERIOD_M1”);

case 2: // M1

return(“PERIOD_M5”);

case 3:

return(“PERIOD_M15”);

case 4:

return(“PERIOD_M30”);

case 5:

return(“PERIOD_H1”);

case 6:

return(“PERIOD_H4”);

case 7:

return(“PERIOD_D1”);

case 8:

return(“PERIOD_W1”);

case 9:

return(“PERIOD_MN1”);

default:

return(“undefined ” + Value);

}

}

相关资源

暂无评论...