#property indicator_chart_window

#property indicator_buffers 2

#property indicator_color1 Lime

#property indicator_color2 Red

bool Gi_unused_76 = FALSE;

int Gi_unused_80 = 2008;

int Gi_unused_84 = 3;

int Gi_unused_88 = 75;

int Gi_unused_92 = 70;

int Gi_unused_96 = 77;

int Gi_unused_100 = 109;

int Gi_unused_104 = 52;

string Gs_dummy_108;

double Gd_unused_116 = 15.0;

double Gd_unused_124 = 45.0;

int Gi_unused_132 = 0;

int Gi_unused_136 = 21;

int Gi_unused_140 = 1;

int Gi_unused_144 = 6;

int Gi_unused_148 = -1;

int Gi_unused_152 = 240;

int Gi_unused_156 = -4;

double Gd_unused_160 = 0.3;

string Gs_dummy_168;

string Gs_dummy_176;

string Gs_dummy_184;

string Gs_dummy_192;

int Gi_216 = 0;

int Gi_220 = 17;

int Gi_224 = 3;

double Gd_228 = 25.0;

int Gi_236 = 159;

string Gs_240;

double Gd_248;

int G_bars_256 = 0;

bool Gi_260 = TRUE;

extern string Alert_Setting = “———- Alert Setting”;

extern bool EnableAlert = TRUE;

extern string SoundFilename = “alert.wav”;

int Gi_284;

int Gi_288;

int Gi_292;

int Gi_296;

int G_count_300 = 0;

int G_count_304 = 0;

int Gi_unused_308 = 0;

int Gi_unused_312 = 0;

double Gd_316;

double G_high_324;

double G_low_332;

double G_ibuf_340[];

double G_ibuf_344[];

int Gi_unused_356 = 0;

int Gi_unused_360 = 0;

int Gi_unused_364 = 0;

int Gi_unused_368 = 0;

int Gi_unused_372 = 0;

double Gd_unused_376 = 0.0;

double Gd_unused_384 = 0.0;

double Gd_unused_392 = 0.0;

int Gi_unused_400 = 0;

int Gi_unused_420 = 0;

int Gi_unused_424 = 0;

int Gi_unused_428 = 50;

int Gi_unused_432 = 2;

int Gi_unused_436 = 100;

int Gi_unused_440 = 2;

int Gi_unused_444 = 200;

int Gi_unused_448 = 2;

// E37F0136AA3FFAF149B351F6A4C948E9

int init() {

if (Bars < Gi_216 + Gd_228 || Gi_216 == 0) Gi_288 = Bars – Gd_228;

else Gi_288 = Gi_216;

IndicatorBuffers(2);

IndicatorShortName(“SHI_SilverTrendSig”);

SetIndexStyle(0, DRAW_ARROW, STYLE_SOLID, Gi_224);

SetIndexStyle(1, DRAW_ARROW, STYLE_SOLID, Gi_224);

SetIndexArrow(0, Gi_236);

SetIndexArrow(1, Gi_236);

SetIndexBuffer(0, G_ibuf_344);

SetIndexBuffer(1, G_ibuf_340);

SetIndexDrawBegin(0, Bars – Gi_288);

SetIndexDrawBegin(1, Bars – Gi_288);

ArrayInitialize(G_ibuf_340, 0.0);

ArrayInitialize(G_ibuf_344, 0.0);

return (0);

}

// 52D46093050F38C27267BCE42543EF60

int deinit() {

return (0);

}

// B3AA0053540040F9E473EAD4D03C19A7

void f0_0() {

string Ls_0 = “”;

int Li_unused_8 = 1;

if (Digits < 4) Gd_248 = 0.01;

else Gd_248 = 0.0001;

if (G_bars_256 != Bars) G_bars_256 = Bars;

double iatr_12 = iATR(Symbol(), Period(), 5, 1);

double Ld_20 = 1.45 * MathRound(iatr_12 * MathPow(7, Digits));

double Ld_28 = 2.0 * Ld_20;

Ls_0 = Ls_0

+ “\n ”

+ “\n ”

+ “\n ”

+ “\n ………………………………………. ”

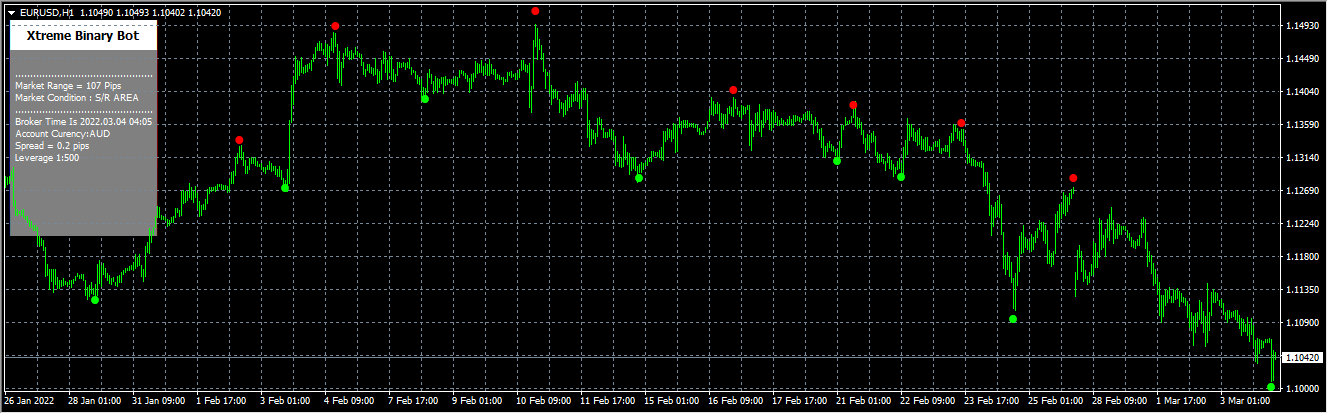

+ “\n Market Range = ” + DoubleToStr(Ld_28, 0) + ” Pips ”

+ “\n Market Condition : ” + Gs_240 + “”

+ “\n ………………………………………. ”

+ “\n Broker Time Is ” + TimeToStr(TimeCurrent()) + “”

+ “\n Account Curency:” + AccountCurrency() + “”

+ “\n Spread = ” + DoubleToStr((Ask – Bid) / Gd_248, 1) + ” pips”

+ “\n Leverage 1:” + AccountLeverage() + “”;

Comment(Ls_0);

if (ObjectFind(“LV”) < 0) {

ObjectCreate(“LV”, OBJ_LABEL, 0, 0, 0);

ObjectSetText(“LV”, “Xtreme Binary Bot”, 9, “Tahoma Bold”, Black);

ObjectSet(“LV”, OBJPROP_CORNER, 0);

ObjectSet(“LV”, OBJPROP_BACK, FALSE);

ObjectSet(“LV”, OBJPROP_XDISTANCE, 22);

ObjectSet(“LV”, OBJPROP_YDISTANCE, 23);

}

if (ObjectFind(“BKGR”) < 0) {

ObjectCreate(“BKGR”, OBJ_LABEL, 0, 0, 0);

ObjectSetText(“BKGR”, “g”, 110, “Webdings”, White);

ObjectSet(“BKGR”, OBJPROP_CORNER, 0);

ObjectSet(“BKGR”, OBJPROP_BACK, TRUE);

ObjectSet(“BKGR”, OBJPROP_XDISTANCE, 5);

ObjectSet(“BKGR”, OBJPROP_YDISTANCE, 15);

}

if (ObjectFind(“BKGR2”) < 0) {

ObjectCreate(“BKGR2”, OBJ_LABEL, 0, 0, 0);

ObjectSetText(“BKGR2”, “g”, 110, “Webdings”, Gray);

ObjectSet(“BKGR2”, OBJPROP_BACK, TRUE);

ObjectSet(“BKGR2”, OBJPROP_XDISTANCE, 5);

ObjectSet(“BKGR2”, OBJPROP_YDISTANCE, 60);

}

if (ObjectFind(“BKGR3”) < 0) {

ObjectCreate(“BKGR3”, OBJ_LABEL, 0, 0, 0);

ObjectSetText(“BKGR3”, “g”, 110, “Webdings”, Gray);

ObjectSet(“BKGR3”, OBJPROP_CORNER, 0);

ObjectSet(“BKGR3”, OBJPROP_BACK, TRUE);

ObjectSet(“BKGR3”, OBJPROP_XDISTANCE, 5);

ObjectSet(“BKGR3”, OBJPROP_YDISTANCE, 45);

}

if (ObjectFind(“BKGR4”) < 0) {

ObjectCreate(“BKGR4”, OBJ_LABEL, 0, 0, 0);

ObjectSetText(“BKGR4”, “g”, 110, “Webdings”, Gray);

ObjectSet(“BKGR4”, OBJPROP_CORNER, 0);

ObjectSet(“BKGR4”, OBJPROP_BACK, TRUE);

ObjectSet(“BKGR4”, OBJPROP_XDISTANCE, 5);

ObjectSet(“BKGR4”, OBJPROP_YDISTANCE, 84);

}

}

// EA2B2676C28C0DB26D39331A336C6B92

int start() {

string Ls_unused_84;

string Ls_unused_92;

string Ls_unused_100;

double Lda_unused_120[];

double Lda_unused_124[];

double icci_168;

double imomentum_176;

double imomentum_184;

double iwpr_192;

double iforce_200;

double ibands_208;

double ibands_216;

double ibands_224;

double ima_232;

double ima_240;

double ima_248;

double ibands_256;

double ima_264;

double ima_272;

string Ls_280;

int Li_unused_0 = 5;

int Li_unused_4 = 53;

int Li_unused_64 = 36;

int Li_unused_68 = 20;

int Li_unused_72 = 5;

int Li_unused_76 = 0;

int Li_unused_80 = 0;

double istochastic_108 = iStochastic(NULL, 0, 20, 12, 12, MODE_EMA, 1, MODE_MAIN, 0);

if (istochastic_108 <= 75.0 && istochastic_108 >= 25.0) Gs_240 = “SAFE TRADE”;

else {

if (istochastic_108 > 75.0 && istochastic_108 <= 88.0) Gs_240 = “S/R AREA”;

else {

if (istochastic_108 < 25.0 && istochastic_108 >= 12.0) Gs_240 = “S/R AREA”;

else {

if (istochastic_108 > 88.0) Gs_240 = “HIGH RISK!”;

else

if (istochastic_108 < 12.0) Gs_240 = “HIGH RISK!”;

}

}

}

if (Gi_260) f0_0();

int ind_counted_116 = IndicatorCounted();

int Li_unused_128 = 10;

int Li_unused_132 = 400;

int Li_unused_136 = 1;

int Li_unused_140 = 3;

int Li_unused_144 = 380;

int Li_unused_148 = 65535;

int Li_unused_152 = 16777215;

int Li_unused_164 = 5;

if (ind_counted_116 < 0) return (-1);

if (Gi_288 > Bars – ind_counted_116) Gi_288 = Bars – ind_counted_116;

for (Gi_284 = 1; Gi_284 < Gi_288; Gi_284++) {

Gd_316 = 0;

for (Gi_292 = Gi_284; Gi_292 < Gi_284 + 10; Gi_292++) Gd_316 += (Gi_284 + 10 – Gi_292) * (High[Gi_292] – Low[Gi_292]);

Gd_316 /= 55.0;

G_high_324 = High[iHighest(NULL, 0, MODE_HIGH, Gd_228, Gi_284)];

G_low_332 = Low[iLowest(NULL, 0, MODE_LOW, Gd_228, Gi_284)];

HideTestIndicators(TRUE);

icci_168 = iCCI(Symbol(), PERIOD_M1, 80, PRICE_CLOSE, 0);

imomentum_176 = iMomentum(Symbol(), PERIOD_M1, 60, PRICE_CLOSE, 0);

imomentum_184 = iMomentum(Symbol(), PERIOD_M5, 4, PRICE_CLOSE, 0);

iwpr_192 = iWPR(Symbol(), PERIOD_M1, 14, 0);

iforce_200 = iForce(Symbol(), PERIOD_M5, 13, MODE_SMA, PRICE_CLOSE, 0);

ibands_208 = iBands(Symbol(), PERIOD_M5, 20, 2, 0, PRICE_WEIGHTED, MODE_UPPER, 1);

ibands_216 = iBands(Symbol(), PERIOD_M5, 20, 2, 0, PRICE_WEIGHTED, MODE_BASE, 1);

ibands_224 = iBands(Symbol(), PERIOD_M5, 20, 2, 0, PRICE_WEIGHTED, MODE_LOWER, 1);

ima_232 = iMA(Symbol(), PERIOD_M5, 1, 0, MODE_EMA, PRICE_HIGH, 0);

ima_240 = iMA(Symbol(), PERIOD_M5, 1, 0, MODE_EMA, PRICE_MEDIAN, 0);

ima_248 = iMA(Symbol(), PERIOD_M5, 1, 0, MODE_EMA, PRICE_LOW, 0);

ibands_256 = iBands(Symbol(), PERIOD_M5, 20, 2, 0, PRICE_WEIGHTED, MODE_UPPER, 0);

ima_264 = iMA(Symbol(), PERIOD_M1, 1, 0, MODE_EMA, PRICE_MEDIAN, 0);

ima_272 = iMA(Symbol(), PERIOD_M1, 1, 0, MODE_EMA, PRICE_LOW, 0);

HideTestIndicators(FALSE);

if (Close[Gi_284] > G_high_324 – (G_high_324 – G_low_332) * Gi_220 / 100.0 && Gi_296 != 1) {

G_ibuf_340[Gi_284] = High[Gi_284] + Gd_316 / 2.0;

if (Close[Gi_284] > G_high_324 – (G_high_324 – G_low_332) * Gi_220 / 100.0 && Gi_296 != 1) Gi_296 = 1;

if (Close[Gi_284] > G_high_324 – (G_high_324 – G_low_332) * Gi_220 / 100.0 && Gi_296 != 1) G_count_304 = 0;

} else {

if (Close[Gi_284] < G_low_332 + (G_high_324 – G_low_332) * Gi_220 / 100.0 && Gi_296 != -1) {

G_ibuf_344[Gi_284] = Low[Gi_284] – Gd_316 / 2.0;

if (Close[Gi_284] < G_low_332 + (G_high_324 – G_low_332) * Gi_220 / 100.0 && Gi_296 != -1) Gi_296 = -1;

if (Close[Gi_284] < G_low_332 + (G_high_324 – G_low_332) * Gi_220 / 100.0 && Gi_296 != -1) G_count_300 = 0;

}

}

}

if (EnableAlert) {

if (Gi_296 == 1 && G_count_300 == 1) Alert(Symbol(), ” – “, “BUY – UP DIRECTION !”);

if (Gi_296 == 1 && G_count_300 == 1) Alert(Ls_280);

if (Gi_296 == 1 && G_count_300 == 1) PlaySound(SoundFilename);

if (Gi_296 == 1 && G_count_300 == 1) G_count_300++;

if (Gi_296 == -1 && G_count_304 == 1) Alert(Symbol(), ” – “, “SELL – DOWN DIRECTION !”);

if (Gi_296 == -1 && G_count_304 == 1) Alert(Ls_280);

if (Gi_296 == -1 && G_count_304 == 1) PlaySound(SoundFilename);

if (Gi_296 == -1 && G_count_304 == 1) G_count_304++;

}

return (0);

}

相关资源

暂无评论...